What Credit Score Do You Need to Get the Capital One Venture Rewards Card? Requirements & Approval Tips in 2025

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

The Capital One Venture Rewards Credit Card is among the most popular entry-level travel credit cards. With a $95 annual fee, up to 5x miles per dollar spent on travel purchases booked through Capital One, and 2x miles per dollar spent on all other purchases, it is perfect for both infrequent and frequent travelers. Additionally, it features premium travel benefits, including two complimentary Capital One Lounge visits per year and up to a $100 application fee credit for Global Entry or TSA PreCheck.

This article is going to outline the minimum credit score required to get approved for the Capital One Venture Card as well as other requirements and application tips.

| Key Capital One Venture Rewards Card Benefits |

|---|

|

| – Annual Fee: $95 – Current Bonus: Earn 75,000 miles by spending $4,000 within the first three months – Earn 5x miles per Dollar spent for hotels and rental cars booked through Capital One – Earn 5x miles per Dollar spent for Turo rental car bookings (through 5/16/23) – Earn unlimited 2x miles per Dollar spent on every other purchase – Up to $100 Credit for Global Entry or TSA PreCheck application fees (every 4 years) – Two Yearly Complimentary lounge passes to Capital One Lounges or Plaza Premium Lounges – Good to Excellent Credit Score Required (670+) |

Table of Contents

Credit Scored Required For The Capital One Venture Rewards Credit Card

You should have at least a 670 credit score before applying for the Capital One Venture Card. Ideally, your score is above 700 when applying for better approval odds. Those with scores of 750+ have an excellent chance of getting approved.

Capital One recommends applicants have excellent credit before applying. Other sources recommend having good to excellent credit. The definition of good to excellent credit depends on the source, but we view the range as 670-850.

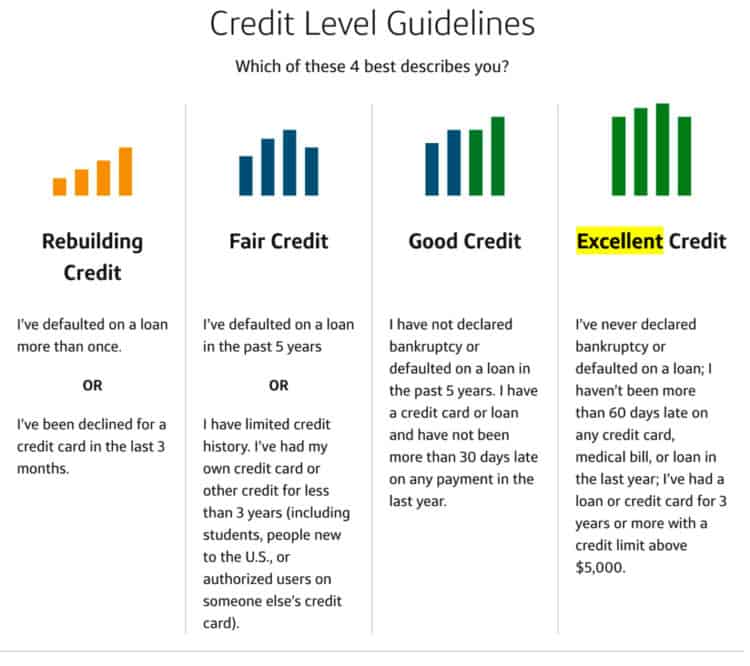

Capital One Credit Level Guidelines

Capital One clearly states what it views as good to excellent credit.

As the table shows, Capital One believes those with excellent credit meet the following conditions:

- Have not been more than 60 days late on a loan, medical bill, or credit card bill in the past year.

- Have had a credit card or loan for three years or longer with a credit card limit above $5,000.

- Have never defaulted on a loan or declared bankruptcy.

Capital One has looser guidelines when defining good credit:

- Have not defaulted on a loan or declared bankruptcy in the past five years.

- Have not been more than 30 days late on a loan or credit card in the past year

Those with fair or poor credit are unlikely to get approved. In some cases, you may be denied even if you have an excellent credit score. Remember, credit score is a major factor, but it is not the only thing Capital One looks at.

The Vacationer Tip

Do you have excellent credit and are ready for your next travel rewards credit card? Learn How to Apply for The Capital One Venture Rewards Credit Card Here.

Improving Your Credit Score and Odds of Getting Approved for the Venture Card

Here are general methods to improve your credit score as well as ways to increase your odds of getting approved for the Capital One Venture Card.

Ways to Improve Your Credit Score

Before applying for the Venture Card, you should check your credit score. Many credit card companies offer free credit monitoring, and that includes Capital One. It’s CreditWise platform allows you to view you credit score from TransUnion and Experian, so you know where you stand. Other companies with free credit monitoring include Credit Karma and NerdWallet. Additionally, those companies shows you other important things that may be affecting your credit score. Here are the most important factors.

- Credit Utilization – The ratio of how much credit you are using to your available credit. For example, your credit utilization ratio is 75% if your balance is $750 and your available credit is $1,000. Aim for a utilization ratio under 5%, but anything under 10% is generally acceptable.

- Payment History – Ideally, your payment history is 100%. Anything else will drop your score and send bad messages to Capital One and other lenders.

- Number and Type of Accounts – Credit card account, loans, mortgages, etc.

- Age of Accounts – The average age for all of your credit cards. Lenders like to see a long history of on-time payments.

- Recent Hard Inquires – The number of hard pulls on your credit in the past 24 months.

- Derogatory Marks – Liens, bankruptcy, foreclosure.

Each of those factors impact your credit score, but some of them are more important. Ideally, you pay your balance in full every month. If you cannot do that, you should keep your total credit utilization ratio below 10 percent. You should never miss a payment, and if you do, do not let it get to 60 days late.

Having a mix of accounts is important, so you should have a few open credit cards along with an open or completely paid off loan. Capital One wants to see a long history of consistent payments for Venture Card applicants.

Derogatory marks, such as liens, are a big red flag for lenders, so it is important you do not have any on your credit report.

Finally, you should limit your hard inquires before applying for the Capital One Venture Rewards Card. If you plan on applying for a few different cards, apply for the Venture Card first.

Do Not Apply if Your Hold More Than Two Personal Capital One Cards

Unfortunately, Capital One only allows individuals to have two personal Capital One credit cards at a given time. That means if you already hold two personal cards, you will automatically be denied for the Capital One Venture Card even if you have an excellent credit score. Here are a few popular Capital One personal cards that you may hold.

- Capital One Venture X Rewards Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One SavorOne Cash Rewards Credit Card

Business credit cards, like the Capital One Spark Miles for Business do not count toward the total.

You Can Only Be Approved for One Capital One Card Every Six Months

Capital One will only approve you for one credit card every six months. Unfortunately, that also includes business credit cards. Before applying for the Capital One Venture Rewards Card, ensure you have not been approved for another Capital One card in the previous six months. You will be denied even if you have a perfect credit score.

Limit Your Credit Inquiries Before Applying

As previously mentioned, we recommend limiting your hard credit pulls before applying for the Capital One Venture Rewards Card. Many people with otherwise perfect credit have been denied for Capital One cards after applying with multiple recent credit inquiries. Applying for a lot of credit cards or loans within a short period of time sends red flags to lenders.

See if You Are Pre-Approved for The Venture Card

Capital One lets you see if you are already pre-approved for the Venture Card without a hard inquiry on your credit report. Simply answer a few questions to see which cards you are pre-approved for. See capitalone.com for more information.

Credit Cards Requiring Similar Credit Scores to the Capital One Venture Rewards Card

Unfortunately, those with a credit score under 700 are going to have a harder time getting approved for the Venture card. The good news is there are other cards requiring similar or lower scores that you may want to also consider.

Capital One VentureOne Rewards Credit Card

The VentureOne Rewards Card is a great starter travel credit card with no annual fee. It earns 5x miles per dollar spent on rental cars and hotels booked through Capital One. For every other purchase, it earns 1.25 miles per dollar spent.

While Capital One says you need excellent credit to get approved, many reports say the approval process is easier than for the Venture Rewards Card. Starting with the VentureOne card allows you to build your credit history and start a relationship with Capital One. You can then upgrade to the Venture Card when your credit score improves.

Please note, if you do upgrade from the VentureOne, you will not be eligible for the Venture Card’s current bonus.

Chase Sapphire Preferred® Card

Like the Capital One Venture Card, the Chase Sapphire Preferred® Card also has a $95 annual fee. It earns up to 5x points per dollar spent on purchases and features a $50 hotel credit (booked through Chase Ultimate Rewards).

Those applying for the Chase Sapphire Preferred® Card need good to excellent credit. Like the Venture Card, that means a score of at least 670, but anything above 700 is ideal.

Before applying for the Sapphire Preferred Card, ensure you are not breaking the Chase 5/24 rule. This rule says Chase will not approve you for a new card if you have opened 5 or more personal cards in the past two years. Unfortunately, that is across all lenders and not just Chase.

Further Reading: What Credit Score Do I Need for the Chase Sapphire Preferred?

FAQ

At the minimum, your score should be 670 before applying. I recommend waiting until your score is at least 700, but your approval odds dramatically increase as your score approaches 750+.

Since it is a Visa Signature card, your minimum credit limit will be $5,000.

It is fairly difficult to get approved for the Capital One Venture Rewards Credit Card. Capital One says you need excellent credit.

The Vacationer’s Final Thoughts

The Capital One Venture Rewards Card is one of the best travel rewards credit cards available. Before applying, check your credit score and make sure it is at least 670. Additionally, ensure there are no liens or other derogatory marks. Finally, apply for the Venture Card before applying for other cards so there are minimal recent hard inquirers on your credit report.

Editorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Get The Vacationer Newsletter

Get highlights of the most important news delivered to your email inbox