CardMatch Tool – The Best Credit Card Offers from Amex, Chase, & More in 2025

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. CardMatch offers may not be available to all users.

If you’re like most people researching new credit cards, the best signup bonus is one of the primary factors. However, comparing rewards credit cards can be challenging as numerous options exist.

If you haven’t tried CardMatch™ yet, it can help you find the best offers from the biggest credit card providers with one search. Additionally, the credit card prequalification tool won’t hurt your credit score as you’re comparing offers.

This CardMatch review can help you decide if this credit card comparison tool can help you find the best travel rewards or cash back offers.

Table of Contents

What is CardMatch?

CardMatch is a free tool through CreditCards.com that lets you prequalify for rewards credit cards and starter credit cards. The service partners with many of the most popular credit card providers, including American Express, Chase, and Citi.

You can pre-qualify for several cards without a hard credit check. Using CardMatch to prequalify can save you time instead of using the prequalification tool on each bank website.

However, a credit inquiry appears on your credit report if you decide to apply for a card.

Comparing credit cards without a credit check can help you quickly find the best offers and rewards.

Most importantly, you don’t have to worry about receiving lots of spam emails and annoying correspondence like other credit monitoring tools.

Participating Issuers

These credit card issuers currently offer rewards cards through CardMatch:

- American Express

- Bank of America

- Chase (you may or may not see Chase offers)

- Citi

- CreditOne Bank

- Greenlight

- U.S. Bank

- WebBank

- Wells Fargo

Unfortunately, you won’t see offers from non-participating banks like Chase or Capital One. Chase was a previous partner so you may notice offers from them again in the future.

Why Use CardMatch?

So, why should you use CardMatch instead of going directly to the bank website?

The best reason is to see special pre-qualified offers that are more valuable than the standard signup bonus.

The precise offer can depend on your creditworthiness and the maximum reward CardMatch currently provides.

Many of the best special offers are for American Express credit cards. Specifically, the special offers focus on these cards:

- The Platinum Card® from American Express

- American Express® Gold Card

- Delta SkyMiles® Platinum American Express Card

- Hilton Honors American Express Surpass® Card

- Blue Cash Preferred® Card from American Express

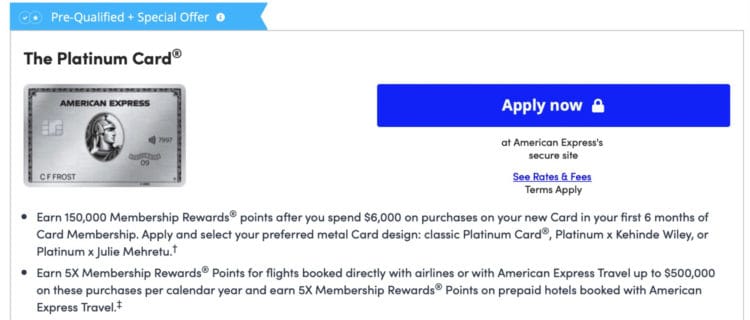

Amex Platinum CardMatch Offer

CardMatch usually has an above-average welcome offer for the American Express Platinum Card.

For example, you might prequalify 150,000 bonus Membership Rewards after spending $8,000 in the first 6 months through CardMatch.

However, you can only earn 80,000 points with the exact same spending requirements if you apply directly through American Express. In this situation, applying through CardMatch lets you receive 70,000 more points worth an additional $700 in travel rewards.

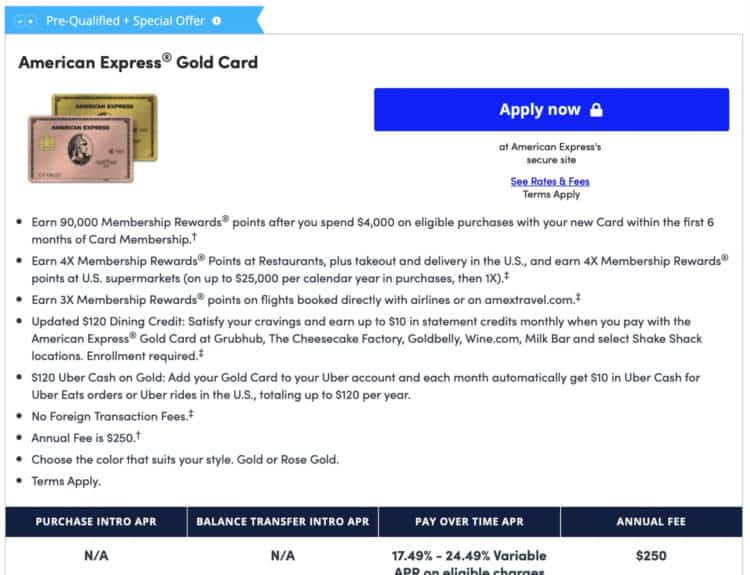

Amex Gold CardMatch Offer

Instead of the standard 60,000 Membership Rewards bonus after spending $4,000 in the first 6 months, you may qualify for up to 90,000 bonus points through CardMatch.

However, other offers might only be 75,000 or 80,000 bonus rewards points depending on the time of year.

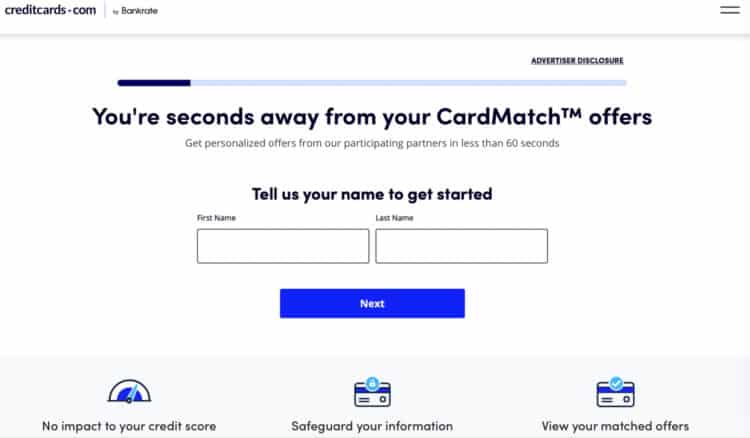

How to Use CardMatch

Here is a step-by-step look at how you can pre-qualify for credit cards within minutes.

Submit Personal Details

First, you visit the CardMatch website and submit these details:

- First and last name (as it appears on your credit report)

- Employment status

- Estimated annual income

- Monthly mortgage and rent payment amount

- Last 4 digits of your Social Security Number (SSN)

- Email address

This may seem like a lot of information to input but banks require these details to process your card application.

The tool uses these details to perform a soft credit check to generate available offers.

Compare Offers

You will see offers for low-interest, cash back, and travel credit cards. In addition, the recommendations can be for flexible rewards programs such as American Express Membership Rewards.

CardMatch may also provide offers for branded airline credit cards and hotel credit cards. However, you must still go directly to the issuer’s website to see the complete catalog.

Several search filters can help narrow down the results to find your desired offer quickly.

Each CardMatch offer displays these pertinent details:

- Signup bonus

- Key benefits

- Introductory purchase APR

- Balance transfer intro APR

- Regular APR

- Annual fee

There is no commitment to apply for a card if you don’t like the available options.

Apply for an Offer

Once you’re ready to apply for an offer, tap the “Apply now” button. Doing so lets you apply for the card directly from the bank website.

If you’re an existing bank customer, you can sign in to pre-fill some of the initial application details.

As a reminder, the CardMatch only prequalifies you for an offer but doesn’t guarantee the bank will approve your application. For example, you might be disqualified if you have applied for too many credit cards recently (i.e., the Chase 5/24 rule) or don’t have a qualifying credit factor.

CardMatch Pros and Cons

Here are the positives and negatives of using the CardMatch tool.

Pros

- Quick and easy: You can view offers from many of the best credit card issuers within minutes. The results also display a wide array of cash and travel rewards cards.

- No hard credit check: You’re only pre-qualifying for credit cards which only require a soft inquiry. The card issuer still performs a hard inquiry once you submit a formal application.

- Targeted offers: CardMatch Special Offers can help you receive a higher signup bonus with similar spending requirements for participating cards. American Express-issued credit cards tend to provide the best offers.

- No spam mail: Typically, a credit card finder sends numerous emails trying to get you to apply for a card. That’s not the case with CardMatch which protects your privacy and inbox.

- Available to all credit scores: You can receive personalized offers for your credit score. It doesn’t matter if you have excellent credit (740+) or fair credit (600+).

Cons

- Prequalification only: You are only prequalifying for offers through a third-party service. The credit card issuer may reject your application for various reasons.

- Not every bank participates: It’s possible to see today’s best credit card offers from many issuers but some institutions don’t participate.

- More offers for excellent credit: Aspiring applicants with an excellent credit score of at least 740 are more likely to receive more offers. Additionally, they might prequalify for more special offers worth more than the standard bonus.

- Most offers match the issuer website: Only a handful of credit card offers are higher than if you apply directly from the website. Thankfully, it can only take less than three minutes to receive your offers. So, you’re not losing a lot of time if CardMatch doesn’t provide a better offer.

The Vacationer credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.

FAQ

The CardMatch offers only require a soft credit inquiry which doesn’t show on your credit report.

CardMatch does an excellent job of matching your credit background with cards with the highest approval odds. Be sure to accurately enter your annual income and housing costs so the tool can be more precise.

CardMatch encrypts the data to protect your personal information. Additionally, the platform won’t sell your email address or phone number.

The Vacationer’s Final Thoughts

It can be worth trying CardMatch to see if you qualify for targeted offers quickly. In particular, American Express cards are the most likely to offer enhanced spending bonuses.

In addition to the offers, you can quickly compare many of the best rewards credit cards, best airline credit cards, best hotel credit cards, and best no-annual-fee credit cards to find your ideal opportunity. However, it’s important to remember that CardMatch offers indicate good approval odds but don’t guarantee final approval.

Editorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

Get The Vacationer Newsletter

Get highlights of the most important news delivered to your email inbox