Vrbo Does Not Code As Travel For Earning Credit Card Bonus Points

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Booking a vacation rental from Vrbo instead of a hotel can make a lot of sense. Prices are often cheaper for large groups of people, and you get the flexibility to stay in locations that may not have any hotels. Add in the fact that many Vrbo rentals come with full kitchens, and the choice becomes even easier.

The drawback comes if you are looking to earn valuable credit card rewards points from Chase, American Express, and other top issuers. As a vacation rental service, you would expect Vrbo rentals to code as travel. Unfortunately, that is not always the case, which means you are likely sacrificing bonus points.

Table of Contents

What Do Vrbo Rentals Code As For Chase Sapphire Credit Cards?

A company called HomeAway acquired Vrbo in 2006. Expedia acquired HomeAway and Vrbo in 2015. For many years, Vrbo rentals would post on credit card statements as HomeAway. Sometimes, rentals would simply post as Vrbo. Instead of coding as travel, they would be categorized as “professional services” or “real estate”.

The problem with this coding is it makes Vrbo vacation rentals ineligible for bonus travel reward points and other benefits. For example, the popular Chase Sapphire Reserve® earns 3x Ultimate Rewards points per dollar spent on travel (or up to 10x points per dollar spent on travel booked through Chase) after the first $300 spent. Since Vrbo rentals do not usually code as travel, Sapphire Reserve cardholders only earn 1x Ultimate Rewards points per dollar spent. It also means Vrbo rental purchases will not count towards the up to $300 per year travel credit.

Does This Only Affect Chase or All Credit Card Companies?

Unfortunately, this is not an issue with just Chase. Credit card companies like American Express, Chase, Capital One, Bank of America, and Citi do not select the code that a transaction will fall under. The merchant, Vrbo in this case, selects their type of business. For unknown reasons, Vrbo categories itself as a “professional service” and “real estate” company instead of a travel company. Chase and other credit card issuers simply offer rewards points based on the category presented by the merchant.

In addition to the Chase Sapphire Reserve, the Chase Sapphire Preferred® Card is also affected. The Sapphire Preferred earns 2x points per dollar spent on travel (or 5x points per dollar spent on travel booked through Chase). Using it to book a Vrbo rentals means you will only receive 1 point per dollar spent as opposed to 2 points per dollar spent.

Best Credit Cards for Vrbo Rentals

Until Vrbo consistently codes its vacation rentals as travel, it makes more sense to use a non-travel focused credit card. We recommend the Chase Freedom Unlimited® or the Citi Double Cash® Card. Neither card has an annual fee, and you will earn more than you would with a Chase Sapphire card. If you want to stick to a travel card, the American Express® Green Card is a good choice. While experiences are mixed, many readers say Vrbo more consistently codes as travel for American Express cards than Chase cards.

- Chase Freedom Unlimited® – earns at least 1.5% cash back on every purchase, so you are guaranteed to earn more than 1x points per dollar spent on Vrbo rentals. If you use the Chase Freedom Unlimited card, you can transfer your points to your Chase Sapphire card for added value.

- Citi Double Cash® Card – earns 2% cash back on every purchase (1% at the time of purchase and 1% once the payment is made). This is another good option for Vrbo purchases because you are guaranteed to earn more than 1x points.

- American Express® Green Card – earns 3x points per dollar spent on travel purchases. Assuming your rental codes as travel, this is the best card for Vrbo purchases, but experiences are mixed.

Capital One Cards are Also Good Choices for Vrbo Rentals

The Capital One Venture Rewards Credit Card and the Capital One Venture X Rewards Credit Card are also good cards to use. Both cards earn 2x miles per dollar spent on Vrbo purchases, and coding does not matter here because it is the default earn rate for all purchases (other than travel purchased through Capital One).

Can My Credit Card Company Just Recategorize My Vrbo Rental To Travel?

From my experience, credit card companies will not change a Vrbo rental code to travel. They may award you extra bonus points, however. For example, I recently booked a Vrbo rental using my Chase Sapphire Reserve card. I had read some people are now seeing their Vrbo rentals categorized as travel, so I was curious about whether or not mine would be.

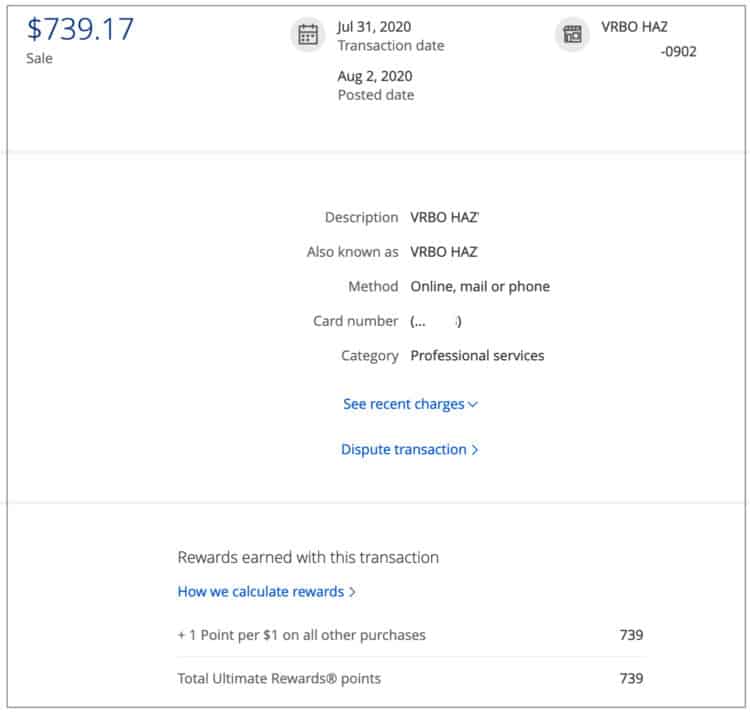

Unfortunately, my rental received the dreaded “professional services” code. This means I only received 739 points for a $739 travel purchase. I contacted Chase via a secure message to see what they could do.

They explained the transaction (listed as Real Estate Agents and Managers – Rentals) was not eligible for bonus rewards since it was not in the proper category. As a “one time courtesy”, Chase awarded me the additional 2x (1478) bonus points.

The transaction is still coded as “professional services”, however. It also did not count toward my $300 travel credit.

The Vacationer Tip

If your Vrbo rental does not code as travel, call your credit card company and ask for an adjustment. Chase should at least provide you with a one-time point adjustment, but it depends on your issuer.

Vrbo Says It Cannot Change It

Out of curiosity, I contacted Vrbo for its stance on the issue. I was told it cannot do anything and it is up to the payment processor to code transactions. At this point, it appears Vrbo is in no rush to get this corrected.

Airbnb Rentals Do Code As Travel

While Vrbo rentals do not code as travel, Airbnb rentals do. That means you can earn 3x points on your Chase Sapphire Reserve® (after the first $300 spent per year) and 2x points on your Chase Sapphire Preferred® Card. It will also count towards the $300 per year travel credit for Sapphire Reserve cardholders. While the points are great, you should not pick Airbnb over Vrbo solely for that reason. Location, accommodations, and total price may be more important than bonus credit card points.

FAQ

Vrbo, meaning Vacation Rentals by Owner, is an online portal allowing you to book vacation rental homes. It is owned by Expedia Group

They may, but they usually do not. Instead, Vrbo rentals generally code as “professional services” or “real estate”.

We recommend the Chase Freedom Unlimited card or the Citi® Double Cash card

Yes, Airbnb does code as travel and earns points for Chase, American Express, and Capital One credit cards.

2023 Update – Things May be Changing

Is Vrbo finally coding as travel in 2023? For some Chase cardholders, it is. Multiple readers have reached out to us over the past six months saying their Vrbo rental purchases are finally earning 3x points per dollar spent on their Chase Sapphire Reserve card. Here is how it is coding.

- VRBO RRD (coding as Travel) and earning 3x

- Professional Services but earning 3x

Having Vrbo code as professional services is nothing new, but it is interesting that some people are seeing 3x points as opposed to 1x points.

The Vacationer’s Final Thoughts

With a large selection of vacation rentals at competitive prices, Vrbo is a great place to book your next trip. Despite the travel category making sense, Vrbo codes its rentals as “professional services” and “real estate”. This means you are unlikely to receive bonus points on your travel-focused credit card. Regardless, we recommend you still consider booking a Vrbo rental if the price is better than hotels and Airbnb.

In 2020, Expedia announced it is retiring its HomeAway U.S. brand to put more focus on Vrbo. Whether or not that will change anything remains to be seen, but most Vrbo rentals are still not coding as travel as of 2023.

Check out The Vacationer’s Recommended Travel Card Picks for the best offers from Chase, Capital One, American Express, and other top issuers. You can also check out the CardMatch tool to see what cards and offers you may already be prequalified for.

Editorial Disclosure: Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Get The Vacationer Newsletter

Get highlights of the most important news delivered to your email inbox