How To Use The Chase Sapphire Reserve® Annual $300 Travel Credit in 2025

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

While the Chase Sapphire Reserve® has a steep $550 annual fee, it includes a variety of benefits that more than justify the cost for frequent travelers. Among the many benefits, the most popular is the annual $300 travel credit.

The credit reimburses cardholders for up to $300 in travel-related expenses every year. This essentially makes the net annual fee of the card $250 ($550-$300). The good news is taking advantage of the $300 travel credit is easy because anything that codes as travel is included.

Table of Contents

How to Earn Chase Sapphire Reserve Travel Statement Credits

You do not have to sign up for anything to start using the annual travel credit. You simply make a purchase that codes as travel with your Chase Sapphire Reserve card, and you will receive a statement credit within a few days.

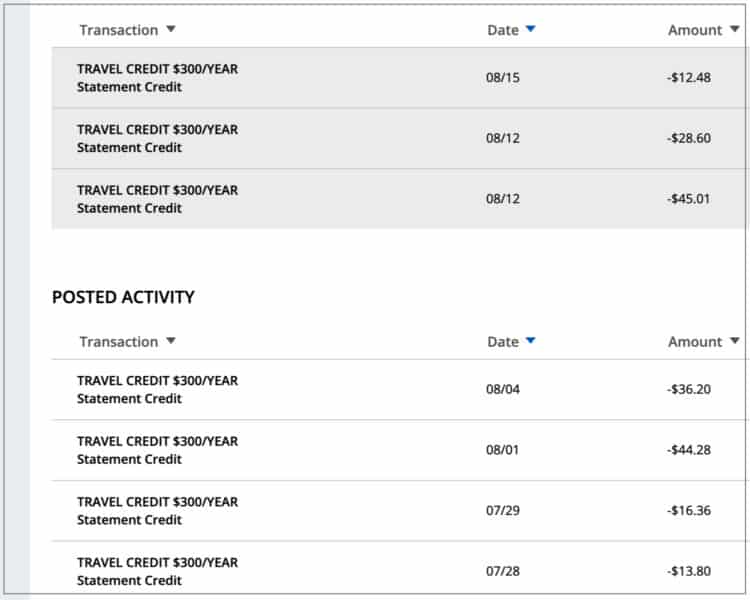

The screenshot below is from my Chase Sapphire Reserve® account. I received each statement credit on the same day the purchases were made.

Here is a look at the travel credits being applied with the eligible transaction. While it could take a few days to post, the travel credit will usually be applied on the same day as the purchase. Please note, these purchases were made during the pandemic when Chase allowed for grocery and gas station purchases to count towards the credit since travel was difficult.

The first $300 in travel purchases each year are only eligible for the travel credit and receive no Chase Ultimate Rewards points. After the $300 is hit, travel purchases earn 3x points per dollar spent (unless booked through Chase Ultimate Rewards, where they may earn as much as 10x points per dollar spent).

Further Reading: Chase Sapphire Reserve Benefits

What Purchases Count Towards The $300 Chase Travel Credit?

As previously mentioned, any purchase coding as travel counts towards the $300 annual credit. These are purchases that usually earn 3x Chase Ultimate Rewards points for travel booked direct or up to 10x points for travel booked through Chase. Unfortunately, you will not earn rewards points on travel purchases until you spend at least $300 in travel with your Chase Sapphire Reserve card.

Here are purchases you can expect to code as travel.

- Hotels & Motels

- Airbnb

- Airlines (tickets, seat upgrades, bags)

- Car Rental Agencies

- Travel Agencies & Discount Travel Sites

- Cruises

- Campgrounds

- Timeshares

- Parking Lots & Parking Garages

- Toll Bridges, Highways, & Tunnels

- Car Services (including Buses, Taxis, Lyft and Uber)

- Trains

While Chase has a broad definition of travel, the merchant has to correctly code it. Certain companies, including Vrbo, usually do not code as travel despite being vacation rental services. If that happens, you will not receive the travel credit or be eligible for any bonus Chase Ultimate Rewards points. Instead, you will earn 1x points per dollar spent.

For that reason, I recommend using a different card for Vrbo purchases. Here are a few recommendations.

- Chase Freedom Unlimited® – Earns at least 1.5% cash back on every purchase, including Vrbo and other travel-related expenses. $0 annual fee.

- Capital One Venture X Rewards Credit Card – Earns 2x miles per dollar spent on all purchases (other than booking via Capital One Travel), including Vrbo and other travel-related expenses.

- American Express® Green Card – Earns 3x Membership Rewards points per dollar spent on travel purchases. Its annual fee is only $150, which makes it an appealing alternative to the Chase Sapphire Reserve.

What Purchases Do Not Count Towards The Chase Travel Credit?

Some travel-related purchases are not eligible for the $300 travel credit or 3x points per dollar spent. Chase says merchants that provide travel-related services are not included. Additionally, items falling within the entertainment space (theme park tickets, tourist attractions) do not count as travel when buying directly.

Here are some purchases you should not expect to code as travel.

- Theme Park Tickets Purchased Directly (Disney World Parks or Six Flags)

- Vrbo & Other Home Rentals (Airbnb does code as travel)

- Travel-related Gift Cards

- Points & Miles

- Real Estate Agents

- In-flight Food & Beverage Purchases

- Other in-flight Purchases Such as Wi-Fi

- Food & Beverage Purchases on Cruises

- Purchases Made at Stores in Airports

- Boat Rentals

Chase is not the one deciding what a purchase is coded as. The merchant in question decides its code, which can cause issues when a transaction should logically code as travel.

The Vacationer Tip

If your travel-related transaction does not code as travel, you should give Chase a call. At the minimum, Chase should bonus you the additional points. Unfortunately, Chase is unlikely to count the transaction towards your annual travel credit if it does not initially code as travel.

Your Travel Credit is Tied To Your Cardmember Year or a Calendar Year

All Chase Sapphire Reserve cardholders receive an annual $300 travel credit every 12 months. Cardholders who signed up before May 21, 2017, have an annual credit period running from after their December statement date through the following year’s December statement. Cardholders who signed up after May 21, 2017, have a 12-month travel credit period based on the month they signed up as well as their first statement.

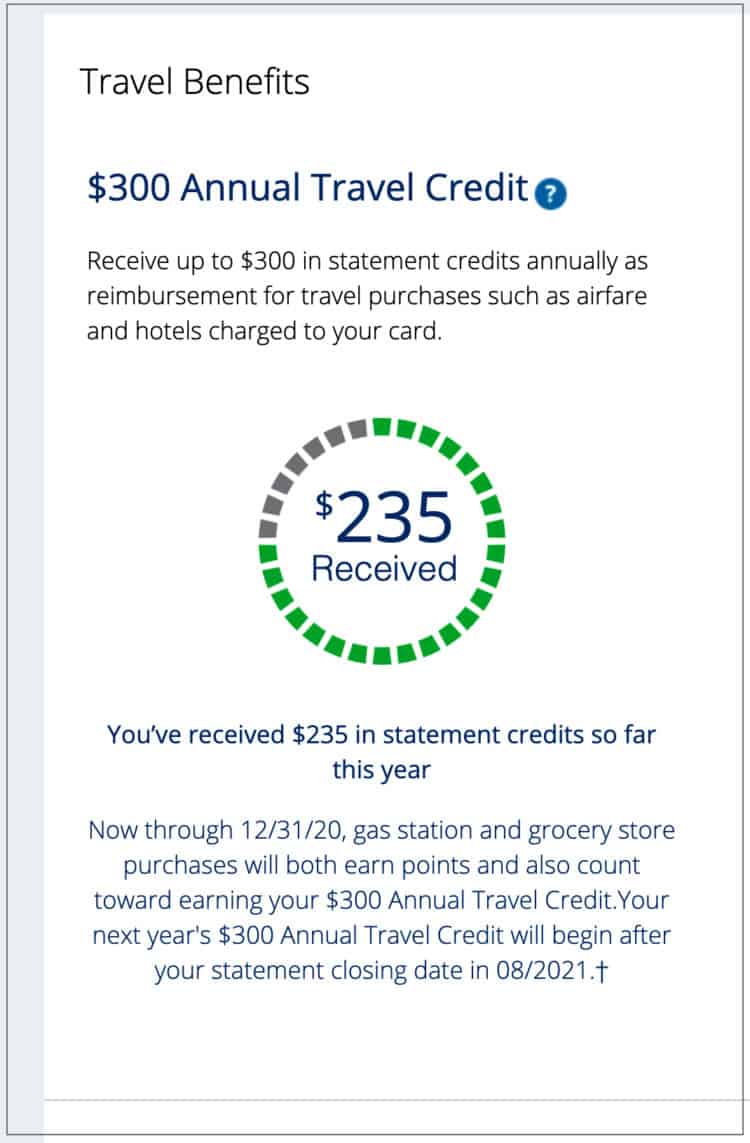

For example, I signed up for my Chase Sapphire Reserve card in July of 2020. My travel credit period for next year will begin after my statement closing date in August of 2023.

How Do I See How Much Of The $300 Travel Credit I Have Left?

Keeping track of your $300 travel credit is easy. Simply log into your Chase account and select your Chase Sapphire Reserve card. Click Card Benefits and navigate to the Rewards Activity section. Scroll to the Travel Benefits Section, and you will see how much of your annual travel credit you have used.

Does the Chase Sapphire Reserve’s $300 Annual Travel Credit Make the $550 Annual Fee worth it?

Chase increased the Sapphire Reserve’s annual fee from $450 to $550 in January of 2020. Despite the $100 increase, it is still a valuable card for many travelers. While the Chase Sapphire Preferred® Card is increasing in popularity due to its $95 annual fee, it cannot compete with the Sapphire Reserve in many aspects (see our Chase Sapphire Reserve vs. Chase Sapphire Preferred comparison article).

In addition to the $300 annual travel credit, here are a few other notable Chase Sapphire Reserve benefits.

- 3x Chase Ultimate Rewards Points per $1 spent on Travel (after the first $300 in annual travel spending) and on Dining

- 5x Points per $1 spent on Flights Purchased via Chase Ultimate Rewards (after the first $300 in annual travel spending)

- 10x Points per $1 spent on Hotel and Rental Car Purchases via Chase Ultimate Rewards (after the first $300 in annual travel spending)

- Up to $100 Statement Credit for Global Entry, TSA PreCheck, or NEXUS Application Fee (every four years)

- $5 Monthly DoorDash Credit while enrolled in DashPass through 12/31/2024 – (see How to Use the $5 Monthly Chase Sapphire Reserve DoorDash Credit)

- Free DashPass Subscription (activate by December 2024)

- 10x Points on Lyft Rides (through March of 2025)

- Primary Auto Collision Insurance for Rental Cars – (see the Best Credit Cards for Rental Car Insurance)

- Points Worth 50% More Booking Travel Through Chase

- Travel Insurance – (see the Best Credit Cards Offering Travel Insurance)

- Free Priority Pass Membership for Airport Lounge Access (see the Best Credit Cards Offering Airport Lounge Access)

Further Reading: Chase Sapphire Preferred Benefits

FAQ

$300

Unused travel credit does not roll over to the next year. If you do not use your full $300 travel credit in your individual 12-month period, you will lose it.

Chase Sapphire Reserve cardholders will not earn Ultimate Rewards points on travel purchases until spending more than $300 on travel in a given year.

It depends on when you signed up. Those who signed up before May 21, 2017, have a period from after their December statement through their next December statement. Those who signed up after May 21, 2017, have 12 months starting on the date of their first statement.

No, the Chase Sapphire Preferred® Card only has a yearly $50 hotel credit when booking through Chase.

The Vacationer’s Final Thoughts

The Chase Sapphire Reserve® is a premium travel credit card, and it has a hefty $550 annual fee. The $300 annual travel credit essentially brings down the annual fee to $250. If you take advantage of the $5 monthly DoorDash statement credit, the annual fee nets out to $190 in 2023 and 2024.

While $190 is still steep, you can more than makeup for the fee by taking advantage of the card’s many benefits, including the up to $100 Global Entry, TSA PreCheck, or NEXUS application fee reimbursement – (see the best credit cards offering Global Entry and TSA PreCheck reimbursement), 3x points per dollar spent on travel and dining, and primary auto collision insurance for rental cars.

Editorial Disclosure: Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Featured Image by Pexels from Pixabay

Get The Vacationer Newsletter

Get highlights of the most important news delivered to your email inbox