Paying Your Taxes With a Credit Card to Earn Bonuses, Points, & Miles for Travel is a Good Idea in 2025 to Pay 2024 Taxes

Nobody enjoys paying taxes. But if you have to pay them, you may as well earn credit card bonuses, points, and miles. The catch is there are fees to use a credit card to pay federal and state taxes. With the 2025 tax season now here, it is time to pay your 2024 taxes.

Here is how to come out ahead despite the fees.

Table of Contents

Federal and State Tax Credit Card Processing Fees

Federal Fees

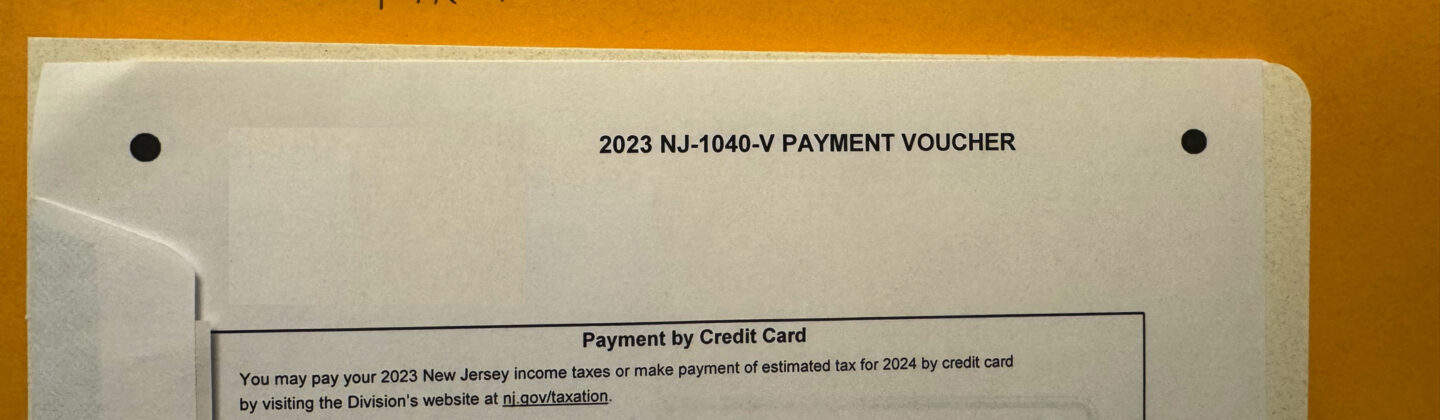

Screenshot: IRS.gov – The screenshot shows current processing fees for paying federal taxes with a credit card.

The IRS currently accepts credit card payments through the following third-party processors.

- Pay1040 – 1.75% Processing Fee (Minimum fee $2.50)

- ACI Payments, Inc. – 1.85% (Minimum fee $2.50)

Each processor accepts Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, PayPal and Click to Pay.

The obvious one to use is pay1040, which is what I will use to pay my 2024 taxes.

State Fees

State tax credit card processing fees are different for each state. For example, I live in New Jersey, and the fee is 2.3 percent of the payment plus $0.50. This is nearly 0.5% higher than the 1.82% federal rate, so it makes the decision to use a credit card a little more difficult. Check your state’s rates before deciding whether to pay with a credit card or your bank account.

How to Come Out Ahead Using a Credit Card to Pay Taxes

You need to earn enough in bonuses, miles, and points to offset the processing fees. Here is how to figure out if it is worth it.

Credit Card Bonuses + Miles or Points

This is the easiest and most obvious one. Many credit card bonuses require you to spend hundreds, if not thousands of dollars, within a few months of signing up. Opening a new credit card with a juicy bonus is a smart way to pay your taxes.

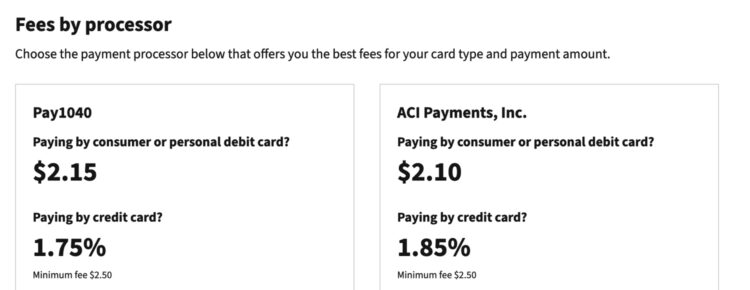

I recently opened the Citi® / AAdvantage® Executive World Elite Mastercard® ($595 annual fee) solely to pay my 2023 taxes. It went a long way towards earning the current welcome bonus offer — 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 in the first three months.

Screenshot: Citi.com – The screenshot shows my tax payments for the 2023 tax year to the IRS and the state of NJ. The $25.83 charge is the federal processing fee, while NJ added the fee to what I owed in a single transaction.

In addition to the 70,000 miles earned from the bonus, I also earned another 7,000 American Airlines AAdvantage® bonus miles from the $7,000 spend as well as 7,000 loyalty points. Since I value American Airlines miles at 1.5 cents per mile, my 77,000 miles are worth around $1,155! Here is a breakdown.

- IRS Tax – $1,419.00 + $25.83 in payUSAtax Processing Fees (for 2024, payUSAtax is no longer an option)

- State Tax – $3,160.00 + $73.18 in NICUSA-NJ Processing Fees

- American Airlines Miles + Loyalty Points Earned – 4,678 since I earn 1x mile and 1x loyalty point per dollar spent on taxes.

While it did not get me to the full $7,000 bonus spend requirement, it got me within $2,322 (I met the bonus requirement on other purchases). Additionally, I earned 4,678 American Airlines miles and loyalty points for the tax payments, which I value at $70.17. The miles itself do not offset the federal and state processing fees of $99.01 ($25.83 + $73.18), but the spend got me close to the 70,000 mile bonus, which I value at $1,050. The loyalty points will help me requalify for my current AAdvantage Elite Status (Platinum Status requires 75,000 loyalty points for the year).

Many credit cards have a much lower bonus minimum spend than the Citi® / AAdvantage® Executive World Elite Mastercard®, so you may be able meet it solely by paying your taxes.

The Vacationer Tip – Best Credit Card Welcome Bonus Offers for Tax Payments

Here are a few of my favorite travel credit cards and their current welcome bonus offers and earn rates for tax payments.

– The Platinum Card® from American Express ($695 annual fee) – Current welcome bonus offer is 80,000 points after spending $8,000 on purchases in the first 6 months. Additionally, the card earns 1x point per dollar spent for tax payments.

– Chase Sapphire Preferred® Card ($95 annual fee) – Current welcome bonus offer is 60,000 points after spending $4,000 on purchases in the first 3 months. Additionally, the card earns 1x point per dollar spent for tax payments.

– Capital One Venture X Rewards Credit Card ($395 annual fee) – Current welcome bonus offer is 75,000 miles after spending $4,000 on purchases in the first 3 months. Additionally, the card earns 2x miles per dollar spent for tax payments.

Miles or Points Only

Without a bonus, it is harder to offset processing fees with most credit cards. While many credit cards have bonus categories, most only earn 1x points per dollar spent for general purchases such as tax payments. Here are a few cards that may make sense to use to pay your taxes without also earning a bonus.

- Capital One Venture X Rewards Credit Card – 2x miles per dollar spent

- Capital One Venture Rewards Credit Card – 2x miles per dollar spent

- Citi Double Cash® Card – 2% back per dollar spent

- Chase Freedom Unlimited® – 1.5% back per dollar spent

- Capital One Quicksilver Cash Rewards Credit Card – 1.5% back per dollar spent

The two best cards are the Capital One Venture X Rewards Credit Card and the Capital One Venture Rewards Credit Card, which both earn 2x miles per dollar spent. That earn rate is higher than the Pay1040 1.75% Processing Fee. Depending on how you redeem Capital One miles, you may be able to enjoy over a 2% return per mile! Additionally, the Citi Double Cash® Card earns 2% cash back per dollar spent, which is also higher than the 1.82% processing fee.

Cards like the Chase Freedom Unlimited® may make sense as well despite only earning 1.5% cash back per dollar spent. Even though its lower than the 1.82% processing fee, you can transfer the points to either the Chase Sapphire Reserve® or Chase Sapphire Preferred® Card. Points can be redeemed at much higher value for travel with both of those cards.

While earn rate is important, the real key is figuring out if your redemption method will offset federal and state tax processing fees.

Other Tips for Paying Your Taxes With a Credit Card

Photo: Phil Dengler of The Vacationer – I opened the Citi® / AAdvantage® Executive World Elite Mastercard® to pay my taxes this year. The photo shows the card on the 2023 Form 1040-V instructions page.

- Consider Annual Fees – While a big bonus is great, a huge annual fee is not. Consider if earning a new bonus through tax payments is worth paying the annual fee. My new Citi® / AAdvantage® Executive World Elite Mastercard® has a $595 annual fee, but I decided the 70,000 mile bonus ($1,050 value) as well as other benefits are worth it.

- Research Redemption Methods – Travel is often the best redemption method for credit card points and miles, whether it be booking directly through the portal or transferring to a partner airline or hotel. American Express, Capital One, and Chase are the three big companies. Before opening a new card or using a current card to pay your taxes, decide how you want to use the miles or points. Each company has different transfer partners, so you could potentially save thousands of dollars by picking one over the other.

- Be Responsible – I only opened a new credit card to pay my taxes because I have the means to pay the balance in full by the due date. That means no late fees or interest charges eating into my bonus and American Airlines miles. Since you already have to offset processing fees when paying your taxes with a credit card, you should not be paying any other fees.

- Consider Paying Quarterly Taxes With a Credit Card Too – If it makes sense, pay your quarterly taxes with a credit card, too.

The Vacationer’s Final Thoughts

Opening up a new credit card to pay your taxes is often a great idea. Big welcome bonuses can be hard to meet, so tax payments can get you there quick. Before doing it, take into account federal and state tax processing fees, the welcome bonus amount and requirements, as well as the earning rate for general spending. If the miles or points are worth more than the processing fees, I recommend signing up.

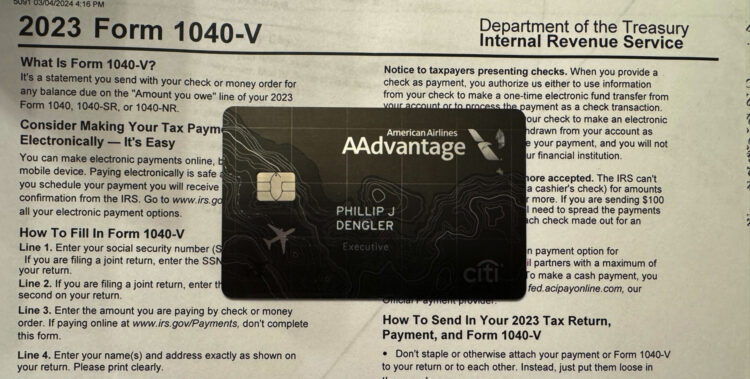

Featured Image – Phil Dengler of The Vacationer – Shows a tax form with a link to pay by credit card.

Get The Vacationer Newsletter

Get highlights of the most important news delivered to your email inbox