Chase Freedom Flex 5% Bonus Categories for Q2 2024 – Amazon & Whole Foods, Hotels, and Restaurants

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

The main benefit of the Chase Freedom Flex℠ is its quarterly rotating 5% cash back (or 5x points per dollar spent) bonus categories. On its own, maximizing the 5% cash back is worth $300 per year ($75 per quarter) since it is only valid on the first $1,500 spent per quarter. When transferred to another business or travel-focused Chase card, the points can be worth much more.

Here is everything you need to know about activating and maximizing the Chase Freedom Flex’s quarterly rotating bonus categories. Please note, these bonus categories are also available to Chase Freedom cardholders, which is no longer open to new applicants.

Table of Contents

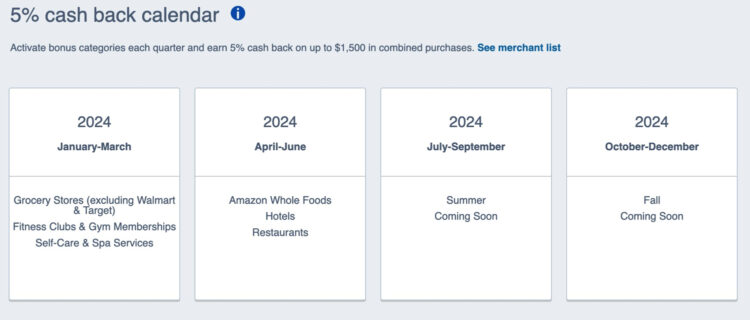

Upcoming Chase Freedom Flex Q2 2024 Bonus Categories (begins April 1, 2024)

Cardholders will earn 5% cash back (on up to $1,500 spent) at Amazon and Whole Foods, Hotels, and Restaurants for Q2 2024. After spending a combined $1,500 for those categories, cardholders will then earn 1%. Here are two important dates you need to know.

- Activate between March 15, 2024, and June 14, 2024, to earn 5% cash back at currently unknown categories.

- Earn 5% cash back at Amazon Whole Foods, Hotels, and Restaurants between April 1, 2024 and June 30, 2024.

Please note, you must activate this benefit between March 15, 2024, and June 14, 2024 to receive the 5% cash back. Otherwise, you will earn the standard 1% (or 1x points per dollar spent). Activation for a quarter begins in the middle of the month before the start date. For example, Q1’s activation time starts in the middle of December.

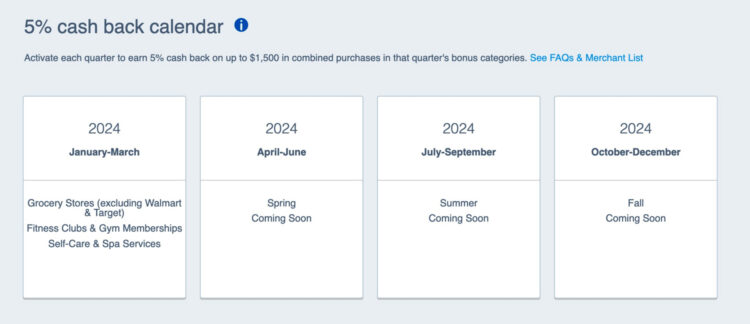

Current Chase Freedom Flex Q1 2024 Bonus Categories (through March 31, 2024)

Freedom Flex cardholders currently earn 5% cash back (on up to $1,500 spent) at Grocery Stores (excluding Walmart & Target), Fitness Clubs & Gym Memberships, & Self-Care & Spa Services for Q1 2024. After spending a combined $1,500 on those categories, cardholders then earn 1%. Here are two important dates you need to know.

- Activate through March 14, 2024, to earn 5% cash back at Grocery Stores (excluding Walmart & Target), Fitness Clubs & Gym Memberships, & Self-Care & Spa Services.

- Earn 5% cash back at Grocery Stores (excluding Walmart & Target), Fitness Clubs & Gym Memberships, & Self-Care & Spa Services between January 1, 2024 and March 31, 2024.

How to Activate The 5% Quarterly Chase Freedom Flex Bonus Categories

There are a few ways to activate your bonus categories.

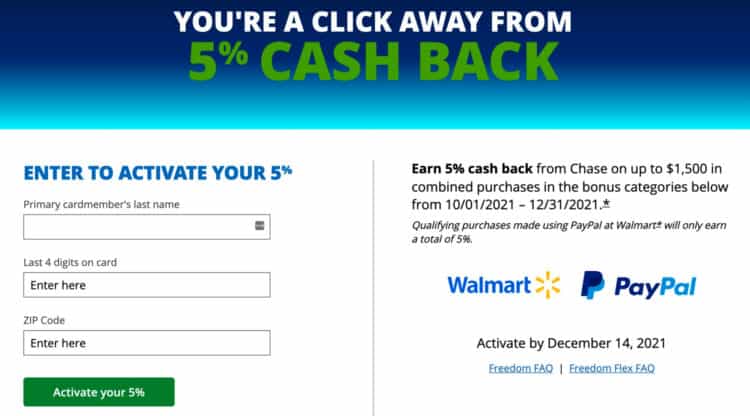

ChaseBonus.com

As long as you have your Freedom Flex card on hand, this is the easiest way to activate your bonus. Simply go to ChaseBonus.com and enter the primary cardholder’s last name, the last four digits of the card, and the zip code. Click the big green button that says “activate your 5%”, and you will be registered.

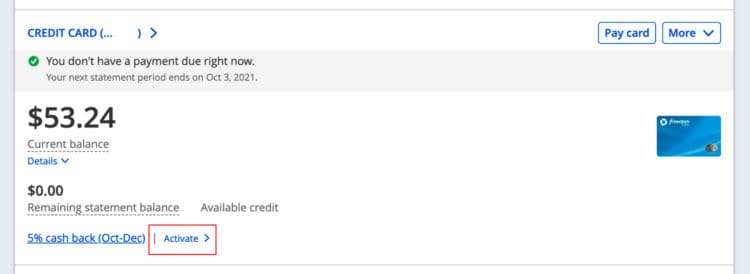

The Chase Website

Activating the Chase Freedom Flex’s quarterly bonus through chase.com is easy. After logging into your account, find your Chase Freedom Flex card under the Accounts list. You will find a 5% cash back link along with dates. Next to it, you will see an Activate link. Click the link, and you can activate the bonus on the next page. This can be done on a desktop computer, tablet, or with a mobile phone.

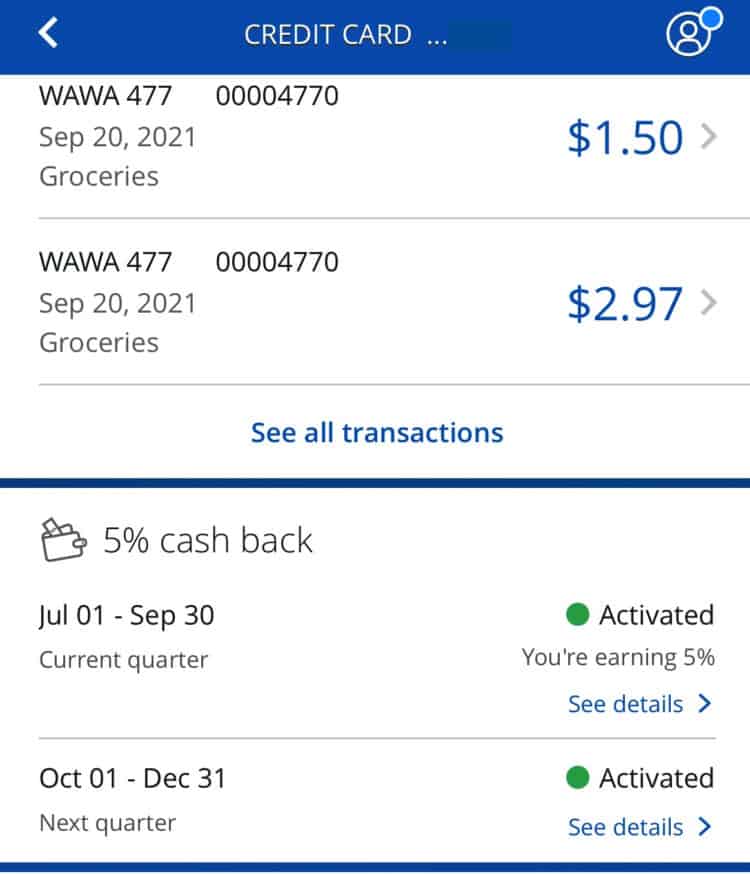

The Chase Mobile App

You can also activate the bonus on the Chase app. After logging into the app, select your Chase Freedom Flex card. Scroll down to the section below your transactions to find the 5% cash back section. You will find the current quarter’s bonus information as well as the chance to activate next quarter’s. Click the activate button and follow the prompts.

Other Ways to Activate

Here are a few other ways to activate the bonus.

- In-Person at a Chase Branch: You can activate the 5% bonus by visiting your nearest Chase branch. While this may be more time-consuming than the other methods, it may make sense if you need personal assistance.

- Email Alert: Set an email alert within your Chase account. Chase will send you an email when the next quarter’s activation begins.

- Calendar Alert: I recommend adding a calendar alert to you phone and/or computer.

- ATM: Use an ATM when withdrawing money to activate the 5% bonus.

- Phone: Call the number on the back of your card.

Whatever method you choose, the most important thing is you activate the bonus with enough time to max out the category.

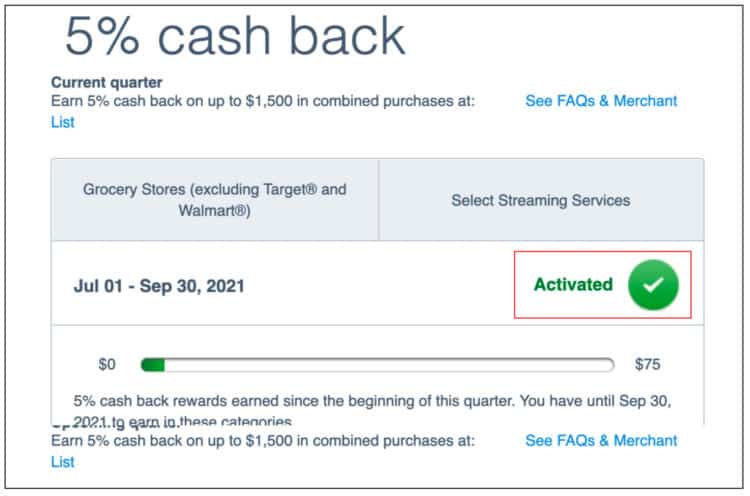

How Do I Check to See if I Successfully Activated the Bonus?

Checking to see if you successfully activated your Freedom Flex bonus is easy. Log in to your Chase account and find your Freedom Flex card in your account list. Click the Details link next to the 5% cash back area. That will take you to a section within Ultimate Rewards that tells you whether or not you have activated the bonus yet for the current and upcoming quarter. If you have not, simply click the big green button to activate.

How Do I Check to See How Much of the Quarterly Bonus I Have Earned?

You can check to see how much of the quarterly bonus you have earned within the Ultimate Rewards section of your Chase account. After logging into your account, navigate to your Freedom Flex card. Click the Details link next to the 5% cash back area. This will take you to a section that shows you how much of the current 5% quarterly bonus you have earned.

Maximizing the Current Quarterly 5% Bonus Categories

Ideally, you max out the bonus categories every single quarter. Remember, you earn 5% on a combined $1,500 in purchases, which comes out to $75 in cash back per quarter. Here is how you can max out the Q3 2023 categories beginning July 1.

Fitness Clubs & Gym Memberships: If possible, pay your gym membership in full to maximize this benefit. Paying monthly may make it tough to really max out the 5% cash back.

Grocery Stores: This does not include Target, Walmart, and other stores that sell groceries but do not specialize in them. Regardless, it should be fairly easy to meet the $1,500 max spend.

Self Care & Spa Services: This does not include self care and spa services purchased at hotels.

Redeeming the 5% Bonus for Maximum Value

While the Chase Freedom Flex is billed as a cash back card, you actually earn points for every purchase. You have the option to redeem points for cash or a statement credit. You can also transfer the points to another Chase credit card for higher redemption values.

Cash or Statement Credit

Redeeming your bonus points for cash or a statement credit is the most straightforward method. Points are worth 1 cent per point. That means you earn $75 (7,500 points) per quarter when maxing out a bonus category; that equates to $300 (30,000 points) per year. There is nothing wrong with redeeming for cash, but there are more lucrative methods.

Transfer the Points to Another Chase Business or Travel Card

You can redeem points for 2 cents per point or more when transferring them to another Chase card. Here are the current redemption values for other popular Chase cards when booking travel through Chase.

- Chase Sapphire Reserve®: 1.5 cents per point (50% more value)

- Chase Sapphire Preferred® Card: 1.25 cents per point (25% more value)

- Ink Business Preferred® Credit Card: 1.25 cents per point (25% more value)

Per quarter, the 7,500 point (worth $75 redeemed for cash) maximum bonus is worth $112.5 when redeemed for travel with the Chase Sapphire Reserve. It is worth $93.75 when redeemed for travel with the Chase Sapphire Preferred and the Ink Business Preferred.

The Vacationer Tip

Transferring the points to one of the three above cards also unlocks airline and hotel partner transfer access. Depending on the transfer offer, your points may be worth 2 cents per point or more. That means the 7,500 point bonus may be worth $150 or more. Transfer partners include Marriott, Hilton, Delta Airlines, and more.

Previous Quarterly Rotating Bonus Categories

While the order may change, bonus categories tend to be fairly predictable year-to-year. Here are a few of the popular ones and some tips on maximizing value. You should expect to see some of these in 2023 and beyond.

Amazon: Amazon usually pops up every few years. Sometimes, it is combined with Whole Foods. Set your Freedom Flex card as your default Amazon payment method for the quarter. Since Whole Foods is more expensive than most grocery stores, it may not make sense to start making all of your grocery purchases there just for the bonus.

EV Charging: Those with an electric vehicle will like this one. Simply use your Freedom Flex card when using EV charging stations for your car or a rental.

Fitness Clubs & Gym Memberships: If possible, pay your gym membership in full to maximize this benefit. Paying monthly may make it tough to really max out the 5% cash back.

Gas Stations: This is usually one of the tougher categories to max out. The good news is it is usually combined with another category. In addition to purchasing all of your gas with the Freedom Flex card, consider purchasing other necessary products the gas station may sell. Please note, only businesses that specialize in selling gas will qualify.

Grocery Stores: This does not include Target, Walmart, and other stores that sell groceries but do not specialize in them. Regardless, it should be fairly easy to meet the $1,500 max spend.

Home Improvement Stores: Think hardware stores and merchants like Home Depot and Lowes. There are a lot of exclusions with this category, however. While grocery stores and warehouses may sell home improvement items, they do not qualify for the bonus.

Internet, Cable, & Phone Services: Unless you have a huge phone or cable bill, this one is difficult to max out on its own. Ensure your Freedom Flex card is set as your payment method for your internet, cable, and phone bill for the quarter. Please note, equipment is not eligible.

Lowes: This is perfect for the spring. Buy all of your outdoor essentials at Lowes, including flowers, lawn mowers, mulch, and more.

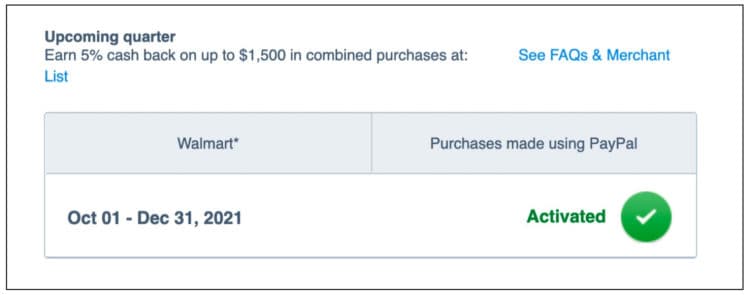

PayPal: Set your Chase Freedom Flex as your primary payment method for PayPal. When shopping online, you should use the PayPal option whenever possible if a merchant accepts it. You may be surprised how many large merchants accept PayPal, so it should be fairly easy to rack up bonus cash back. Xoom transfer service purchases do not count.

Select Live Entertainment: Before booking any entertainment or events, see if it qualifies to earn 5% cash back.

Target: Q1 2023 marked the first time Target is a category. Purchase household essentials, groceries, electronics, toys, and more and earn 5% cash back while doing it. Even if you have a Target RedCard, you should use your Freedom Flex or Freedom card since Chase points are potentially more valuable.

Walmart: Set your Chase Freedom Flex as your primary payment method for Walmart.com purchases. You should also use your Freedom Flex card for all purchases made at Walmart stores. Please note, only Walmart branded purchases count. Third-party restaurants, gas stations, and other merchants operating at Walmart are not eligible for the 5% bonus. The good news is groceries purchased at Walmart stores are eligible for the bonus.

Wholesale Clubs: Think stores like Costco and BJ’s.

Historical Quarterly Bonus Categories by Date

Here are previous bonus categories dating back to the beginning of 2020.

- Gas Stations, EV Charging, and Select Live Entertainment – Q3 2023

- Amazon and Lowe’s – Q2 2023

- Grocery Stores (excluding Walmart), Target, Fitness Clubs & Gym Memberships – Q1 2023

- Walmart and PayPal – Q4 2022

- Gas Stations, Car Rental Agencies, Movie Theaters and Select Live Entertainment – Q3 2022

- Amazon & Select Streaming Services – Q2 2022

- Grocery Stores & eBay – Q1 2022

- Walmart & PayPal – Q4 2021

- Grocery Stores & Select Streaming Services – Q3 2021

- Gas Stations & Home Improvement Stores – Q2 2021

- Internet, Cable, and Phone Services; Select Streaming Services and Wholesale Clubs – Q1 2021

- Walmart and PayPal – Q4 2020

- Amazon and Whole Foods – Q3 2020

- Grocery stores, Fitness Club Memberships, and Select Streaming Services – Q2 2020

- Internet, Cable, and Phone Services; Gas Stations and Select Streaming Services – Q1 2020

FAQ

Yes, you need to register. This can be done at chasebonus.com, when logged into chase.com, by calling the number on the back of your card, at an ATM, and via email alerts.

Registration starts in the middle of the month before the start of the quarter.

The 5% cash back is available on the first combined $1,500 spent for all of the quarter’s categories. That comes out to $75 per quarter and $300 per year.

While the original Freedom Card is closed to new applicants, current cardholders can earn the same bonuses as the Freedom Flex.

Technically you earn points. Maxing out the category each quarter gives you 7,500 points (or $75 cash).

Common categories include gas stations, grocery stores, home improvement stores, PayPal, select streaming services, and Walmart.

This can easily be done by logging into your online Chase account. Click your Freedom Flex card and navigate to the Ultimate Rewards section. You will see a 5% tab which shows how much of the quarter’s bonus you have earned.

Technically, the bonus is 4% cash back since you already earn 1% cash back per purchase. Either way, it adds up to 5%.

The current category is Grocery Stores (excluding Walmart & Target), Fitness Clubs & Gym Memberships, & Self-Care & Spa Services. It ends March 21, 2024.

The upcoming categories are unknown. They will earn 5% cash back beginning April 1, 2024.

The statement posting date. For example, you will not receive bonus points if you make a purchase on the last date of a quarter and it posts the next quarter.

The Vacationer’s Final Thoughts

I use my Chase Freedom Flex often and highly recommend it. Because it earns up to 5% and has no annual fee (see the best credit cards with no annual fee), it is a great addition for anyone looking to maximize Chase points and redemptions. After maxing out a particular quarter, I transfer the points to my Chase Sapphire Reserve and redeem the points at 50% more value. I also stack it with my Chase Freedom Unlimited® to earn at least 1.5% cash back on every purchase. Remember to register for the quarterly bonus and keep track of your spending. That will prevent you from continuing to spend in a bonus category after you have maxed them out.

Editorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Get The Vacationer Newsletter

Get highlights of the most important news delivered to your email inbox