What Credit Score Do You Need to Get the Chase Sapphire Preferred Card? Requirements & Approval Tips in 2025

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Many travel lovers consider the Chase Sapphire Preferred® Card as one of the most desirable travel rewards credit cards. Its best benefits include a 25% travel redemption bonus, 1:1 point transfers, and valuable travel perks such as 10% anniversary points and robust travel insurance.

However, qualifying for the Chase Sapphire Preferred can be somewhat challenging. This guide will help determine if your credit score and other credit factors provide strong approval odds.

| Key Chase Sapphire Preferred Card Benefits |

|---|

|

| Annual Fee: $95 Earn 5x Ultimate Rewards on travel purchased through Chase Ultimate Rewards (excludes hotel purchases qualifying for the $50 Annual Ultimate Rewards Hotel Credit Earn 2x points on all remaining travel purchases Earn 3x points on qualifying dining, online grocery orders, and streaming services Redeem points for 25% more on award travel booked through Chase Ultimate Rewards 1:1 point transfers to participating airlines and hotels Account anniversary bonus equal to 10% of Ultimate Rewards earned during the year Travel Insurance and Primary Rental Car Coverage Good to Excellent credit recommended (670+) |

Table of Contents

Credit Score Needed for the Chase Sapphire Preferred

Wait to apply for the Chase Sapphire Preferred Card with a credit score above 670. This threshold is the start of good credit. Applicants with a credit score from 740 to 850 have “excellent credit,” which is the highest rating and can have the best approval odds.

It’s important to note that Chase Bank doesn’t disclose any minimum credit score requirements or a recommended credit range.

The credit score requirements mentioned above are sourced from data points provided by actual applicants. Additionally, similar travel rewards credit cards require good or excellent credit.

Once your application is approved, your minimum credit limit will be $5,000 as it’s a Visa Signature product. Although, it can be higher if you’re a well-qualified applicant.

The Vacationer Tip

Do you have excellent credit and are ready for your next travel rewards credit card? Learn How to Apply for the Chase Sapphire Preferred Card Here.

Other Chase Sapphire Preferred Approval Requirements

While a high credit score is a positive indicator that you can responsibly manage credit and pay off your balance, Chase analyzes several personal and credit factors during the approval process.

Are You a Returning Sapphire Member?

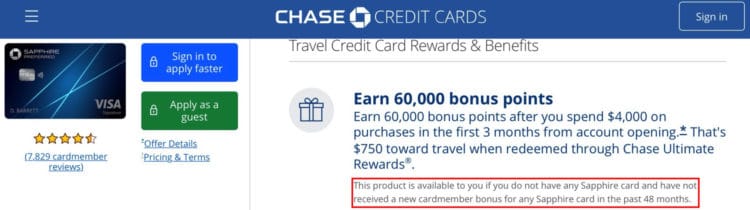

Chase only discloses two minimum requirements in the Sapphire Preferred terms and conditions. The first is determining if you’re a first-time applicant or a previous Sapphire member.

The card provider states explicitly, “This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months.”

Unfortunately, you cannot apply for the Chase Sapphire Preferred or the Chase Sapphire Reserve® if you fall into one of these categories:

- Currently have a Sapphire product

- Have received a Sapphire bonus within the last four years (48 months)

Minimum Age

The second publicly-disclosed application requirement is the minimum age. The age threshold is universal to all credit cards and ultimately depends on your state of residence.

You must be at least 18 years old to apply for the Sapphire Preferred although these states and provinces have stricter requirements:

- Alabama: 19 years

- Nebraska: 19 years

- Puerto Rico: 21 years

Additionally, you will need a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

Potential Chase Restrictions

Several other unspoken policies can influence the application decision.

Chase 5/24 Rule

The Chase 5/24 policy potentially has the most extensive effect for aspiring applicants.

While you won’t see this policy in any of Chase’s literature, it’s widely known that your application for most Chase credit cards will be automatically declined when you have too many new credit cards.

Specifically, if you have added five or more personal credit cards to your credit reports in the last 24 months. These credit lines either list you as the primary member or as an authorized user. It doesn’t matter if Chase or a competing bank issues these products.

So, this rule won’t disqualify you if you have only applied or been approved for four or fewer cards within the last two years.

While most cards are subject to the Chase 5/24 rule, there are two notable exceptions:

- Credit cards without a preset spending limit (i.e., The Platinum Card® from American Express)

- Chase Ink Business credit cards (i.e., Ink Business Unlimited® Credit Card)

Timing Credit Card Applications

Even if you’re under the 5/24 threshold, you should consider only applying for a new credit card every 90 days to avoid unnecessary red flags.

If you apply for too many cards at once, Chase (and other banks) may shut your existing accounts down as a precautionary measure.

Timing your credit card applications is also a good practice as applying for a card shortly before a mortgage or auto loan may jeopardize the underwriting process for these purchase loans.

Maximum Number of Chase Credit Cards

It’s also common for banks to only allow users to have a maximum number of credit cards from their portfolio. For example, you can only have two Capital One consumer credit cards at a time, although it’s still possible to qualify for their small business or co-brand personal cards.

Chase doesn’t appear to have any credit card maximums but their proprietary algorithm may result in having smaller credit limits for subsequent cards.

As a result, your Sapphire Preferred application might be rejected if Chase deems your recommended credit limit is below the $5,000 minimum for Visa Signature cards.

Annual Income and Monthly Expenses

The bank will analyze your debt-to-income ratio (DTI) to help determine your card spending limit and approval odds.

During the application process, you will provide these stats:

- Annual income

- Employment status (full-time, part-time, self-employed)

- Housing costs

- Type of residence (own or rent)

Chase doesn’t disclose any minimum income threshold or maximum DTI ratios.

Personal Bankruptcy History

While other banks specifically talk about the waiting period after declaring bankruptcy, Chase doesn’t. However, it’s usually best to apply once this event falls off your credit report, generally after seven to 10 years.

As there are exceptions to every rule, one applicant reports an approved application six years after filing for personal bankruptcy.

What to Do Before Applying for the Chase Sapphire Preferred

Observing these practices can improve your approval odds for the Chase Sapphire Preferred.

Improve Your Credit Score

Achieving excellent credit can take years but you can take these steps to see minor improvements within a few months:

- Credit Utilization: Strive to keep your credit card balance below 30% of your total limit at all times. Ideally, your credit utilization should be 10% or lower.

- On-Time Payment History: Paying your statement balance in full every month demonstrates you’re not overspending and helps you avoid interest charges.

- Make Accounts Current: Pay any past-due loan or credit card balance to ensure your accounts are in good standing.

- Report Recurring Payments: Services like Experian Boost can give you credit for rent and utility bills that typically don’t report to the credit bureaus.

Avoiding hard inquiries also keeps your score higher.

Pre-Qualify for Credit Cards

Pre-qualifying for credit cards is a free and quick way to estimate your current approval odds without a hard inquiry. However, getting pre-approved doesn’t guarantee an affirmative application decision.

One option is using CardMatch™ to estimate your approval odds for the Chase Sapphire Preferred and other rewards credit cards for free. Learn more with our CardMatch review.

Another option is getting pre-approved directly through Chase. It’s free, only takes a few minutes, and you can compare your offers between the best Chase credit cards.

Become a Chase Bank Customer

Being a Chase customer can make qualifying for the bank’s best services easier. Initially, you may consider opening a banking account or one of the no-annual-fee rewards cards, such as the Chase Freedom Flex℠ or the Chase Freedom Unlimited®.

In time, you may receive invitations to apply for the Chase Sapphire Preferred. These targeted offers are a reliable indicator that you qualify for the card.

What Happens If You Don’t Get Approved?

Most Chase Sapphire Preferred application decisions are instant although those requiring further review can take up to 10 business days.

If your application is flagged or denied, you can call the Chase reconsideration line for personal credit cards at 1-888-270-2127 to get final approval.

Similar Alternatives to the Chase Sapphire Preferred

Depending on your circumstances, consider these similar travel credit cards from competing banks that can be easier to qualify for.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards requires a good or excellent credit score of at least 670. You will earn at least 2x miles on purchases that you can redeem as travel statement credits or transfer to airlines and hotels (usually at a 1:1 ratio).

Other notable benefits include two free airport lounge visits annually and a Global Entry or TSA PreCheck application fee credit (up to $100 every five years). Its annual fee is $95.

Learn More: What Credit Score Do You Need for the Capital One Venture Rewards Card?

Citi Premier

The Citi Premier® Card earns up to 3 ThankYou points per $1 on purchases and also offers a $100 annual hotel savings benefit. Award flights and 1:1 airline point transfers are the most valuable point redemption options.

You will need a minimum credit score of 670 (good credit) to be eligible for this card. This card’s annual fee is $95.

Related: Best Hotel Credit Cards

Bank of America Travel Rewards

If you’re a Bank of America customer, the Bank of America® Travel Rewards Credit Card can be an enticing option as it doesn’t charge an annual fee and you might be able to enjoy Preferred Rewards benefits.

You will need good or excellent credit (670+) to qualify, but you don’t need to be a BofA customer to apply.

Featured benefits include earning 1.5x points on every purchase. In addition, travel purchases through the Bank of America Travel Center earn 3x with Preferred Rewards members earning from 25% to 75% more points on purchases.

Related: Best No-Annual-Fee Credit Cards

The Vacationer’s Final Thoughts

You should have favorable approval odds for the Chase Sapphire Preferred when you have a good credit score (670+) or an excellent credit score (740+) and are not subject to the Chase 5/24 guidelines.

If you’re a previous Sapphire member, make sure it’s been at least 48 months since receiving your last bonus and you currently don’t hold the Chase Sapphire Reserve. You may also time your application to verify you can meet the signup bonus spending requirement of $4,000 within the first three months.

Further Reading: Chase Sapphire Preferred Current Bonus Points Offer and How to Use the Chase Sapphire Preferred $50 Hotel Credit

Editorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Get The Vacationer Newsletter

Get highlights of the most important news delivered to your email inbox