27 Best Ways to Earn United MileagePlus Miles in 2025

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

United Airlines is a juggernaut in the commercial airline space with an extensive domestic and international service network. The carrier and its Star Alliance partners also gain kudos for not charging fuel surcharges, making award flights affordable to many faraway destinations.

Our comprehensive guide shows you how to earn United MileagePlus® miles every day.

Table of Contents

Use Chase United Credit Cards

Chase Bank offers four consumer and two small business co-brand United Airlines credit cards. All qualifying card purchases earn at least 1 award mile per $1 and you can enjoy other special privileges when you fly on United.

There are also many opportunities to earn bonus miles through exclusive cardmember offers.

Consumer United Airlines Credit Cards

The annual fee for the United personal credit cards ranges from $0 to $525. However, frequent flyers should consider the cards with a higher annual fee first as they can earn up to 4 miles per dollar and offer special perks like airport lounge access and free checked bags.

Note: These cards are listed with the lowest annual fees first. Additionally, you can earn 10,000 bonus miles by referring a friend to any United MileagePlus® Card (up to 100,000 miles per year).

United Gateway℠ Card:

The United Gateway Credit Card has no annual fee or foreign transaction fees. Consider this card if you simply want to focus on earning miles and don’t need the add-on MileagePlus benefits that require paying a yearly card fee.

You will earn 2x United miles on these purchases:

- United purchases

- Gas stations

- Local transit, commuting (includes rideshares, mass transit, tolls, etc.)

All non-bonus purchases earn 1 mile per $1.

This card also provides 25% back on United inflight and Club drink purchases. See our United Gateway℠ Card review.

Related: Best No-Annual-Fee Credit Cards

United℠ Explorer Card:

The United Explorer Card has a $0 introductory annual fee and renews at $95.

The following purchases earn 2 miles per $1:

- United purchases

- Dining (includes eligible delivery services)

- Hotel accommodations booked directly from the hotel

You can also have an easier time qualifying for United Airlines elite status. Every $12,000 in annual card purchases earn 500 PQP (Premier qualifying points), up to 1,000 PQP per year.

Other United MileagePlus benefits include:

- Free first checked bag for you and one companion

- 2 United ClubSM one-time passes each year

- Priority boarding

- 25% savings on in-flight and Club drink purchases

- Up to $100 fee credit for Global Entry, TSA PreCheck, or NEXUS

This card also provides primary auto rental coverage on most rentals worldwide.

Learn More: Best Credit Cards for Global Entry or TSA PreCheck

United Quest℠ Card:

The United Quest Card costs $250 per year and earns up to 3x on purchases:

- 3x on United purchases

- 2x on travel, dining, and select streaming services

- 1x on everything else

Every $12,000 in annual purchases earn 500 PQP (up to 6,000 PQP per year). These bonus PQP apply to status upgrades up to the Premier 1K level.

Some of the featured United travel benefits include:

- Up to $125 annual United purchase credit

- Two 5,000-mile award flight credits

- First and second checked bags are free

- 25% back on in-flight United and Club drink purchases

Related: Best Airline Credit Cards

United Club℠ Infinite Card:

The premium United Club Infinite Card is one of the credit cards you get for the benefits first and earning potential second, as it has a $525 annual fee.

For example, the cardholder enjoys complimentary United Club membership where the primary cardmember and eligible travel companions can visit for free. This perk is worth up to $625 annually and is one of the best credit cards for airport lounge access.

To earn United miles, purchases earn up to 4 miles per $1:

- 4x on United purchases

- 2x on all other travel purchases

- 2x on dining

- 1x for everything else

You will also receive 500 PQP for every $12,000 in annual purchases (up to 4,000 PQP per year).

If you practice the mantra, “Money saved is money earned,” you will enjoy this perk. Primary cardmembers pay 10% fewer miles on United Economy Saver Awards within the continental US and Canada.

This card provides other luxury travel perks to save and enjoy an enhanced experience.

United Airlines Business Credit Cards

Small business travelers can also earn airline miles on work-related purchases.

United℠ Business Card:

The entry-level United Business Card has an intro $0 annual fee for the first year, then $99. You won’t get year-round United Club lounge benefits but you have opportunities to earn MileagePlus miles, PQP, and flight credits.

These purchases earn 2 miles per $1:

- United purchases

- Dining, including eligible delivery services

- Gas stations

- Local transit and commuting

- Office supply stores

Non-bonus purchases earn 1x miles.

The other notable United benefits include:

- Better Together anniversary bonus: 5,000 bonus miles each anniversary when you have both a personal Chase United® credit card and the United℠ Business Card.

- Bonus PQP: Earn up to 1,000 PQP per year by receiving 500 PQP after $12,000 in annual spending.

- $100 United flight credit: After purchasing at least 7 United flight purchases exceeding $100 each in a card anniversary year.

- 25% savings: On in-flight purchases and Club premium drinks

- United Club: 2 one-time passes each year

Transfer Chase Ultimate Rewards

United Airlines is a 1:1 transfer partner for Chase Ultimate Rewards with Chase Sapphire and Chase Ink Business cards requiring an annual fee.

With instant transfer speeds, you can transfer your Ultimate Rewards to United Airlines in 1,000-point increments. There are more than a dozen other airline and hotel partners that you can also use or redeem your points for travel through the Chase travel portal, for optimal flexibility.

Chase Sapphire Preferred® Card:

The Chase Sapphire Preferred® Card has a $95 annual fee and earns up to 5x Ultimate Rewards:

- 5x on travel purchased through Chase Ultimate Rewards

- 2x on other travel purchases

- 3x on dining, eligible delivery services, and select streaming services

- 3x on online grocery purchases (excluding Target, Walmart, and wholesale clubs)

- 1x for everything else

On each card anniversary, you will receive bonus points equal to 10% of your annual earnings.

In addition to the 1:1 point transfers, your points are worth 25% more (1.25 cents) when booking award travel through the Chase Ultimate Rewards travel portal.

Chase Sapphire Reserve®:

The Chase Sapphire Reserve® has a $550 annual fee (and $75 per additional card) and is ideal for premium travelers.

This card earns up to 10x Ultimate Rewards on purchases. Your travel-related purchases start earning rewards points after redeeming the annual $300 travel credit.

- 10x on hotels and car rentals through Chase Ultimate Rewards

- 5x on flights through Chase Ultimate Rewards

- 3x on all remaining travel purchases

- 10x on Chase Dining purchases

- 3x on all remaining dining purchases

- 1x for everything else

The 50% point redemption bonus on award travel redemptions is also a valuable perk. You also receive complimentary Priority Pass Select lounge access and up to $100 in Trusted Traveler program fee reimbursements.

Ink Business Preferred® Credit Card

Small business owners can utilize the Chase Ink Business Preferred® Credit Card ($95 annual fee) to earn up to 3x points.

Cardholders will earn 3 Ultimate Rewards per $1 on the first $150,000 in combined annual purchases for these categories:

- Advertising purchases with search engines and social media sites

- Internet, cable and phone services

- Shipping

- Travel

All remaining purchases earn 1 point per $1. Redeeming points instead of traveling makes each point worth 25% more.

Transfer Marriott Bonvoy Points

Do you belong to the Marriott Bonvoy loyalty program? If so, you can transfer Bonvoy points at a 3:1.1 ratio to United Airlines which is 10% higher than the other airline partners.

As Marriott’s preferred transfer partner, 3,000 Bonvoy points become 1,100 United miles.

You should also consider transferring your points in 60,000-point increments to receive 5,000 bonus miles. This transfer bonus is available to all Marriott airline partners.

It’s possible to accumulate travel points faster through a Marriott Bonvoy credit card.

Two featured cards include:

- Marriott Bonvoy Bold® Credit Card: $0 annual fee, Marriott Bonvoy Silver Elite status, up to 14x on purchases

- Marriott Bonvoy Brilliant® American Express® Card: $650 annual fee (see rates & fees), 1 Free Night Award each renewal (85,000 points or less), and other premium benefits

How to Convert Marriott Vacation Club Points

Marriott Vacation Club timeshare owners can convert Vacation Club points into United miles. The minimum transfer ratio starts at 500 Vacation Club points equal to 8,000 award miles. In the same transaction, you can convert in 250-point increments and receive 4,000 miles.

It’s possible to receive up to 40,000 miles per member per year through this conversion program.

Fly United or United Express

Depending on your MileagePlus status level, you will earn up to 11 miles per $1 eligible fares and Premier qualifying credits.

- Member: 5x

- Silver: 7x

- Gold: 8x

- Platinum: 9x

- Premier 1K: 11x

Basic economy flights will earn award flights but not Premier qualifying credits. Star Alliance partner flights booked through United that start with “016” also earn award miles.

Some of the excluded fares include award flights and mystery deals from flight booking sites. Other specialty tickets will earn distance-based miles instead of being revenue-based.

The Vacationer Tip

Planning to fly United Airlines soon? Check out these guides:

How to Find and Book Cheap Flights

Best Websites for Booking Cheap Flights

Best Days of the Week to Fly

Best Day of the Week to Book Flights

United Airlines Baggage Fees & Allowance

Fly on a Star Alliance Partner

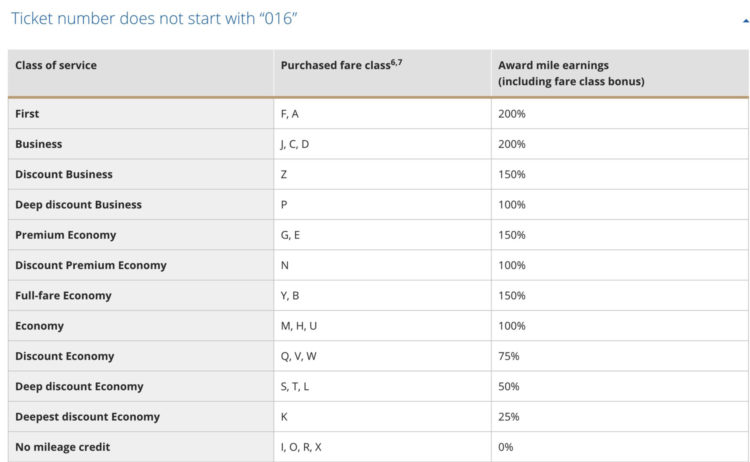

There are over 40 partner airlines that let you earn award miles when you book directly from the airline. Your earning potential depends on the purchased fare class and the airline. These tickets won’t start a “016” like the United-issued fares do.

Here is an example of how much you can earn when buying a Lufthansa ticket.

The 25 Star Alliance member airlines can earn more than the other global partners. For example, you may be able to earn 200% award miles instead of 100%.

Current Star Alliance airlines include:

- Aegean

- Air Canada

- Air China

- Air India

- Air New Zealand

- ANA

- Asiana Airlines

- Austrian

- Avianca

- Brussels Airlines

- CopaAirlines

- Croatia Airlines

- Egyptair

- Ethiopian

- EVA Air

- LOT Polish Airlines

- Lufthansa

- SAS

- Shenzhen Airlines

- Singapore Airlines

- South African Airways

- Swiss

- TAP Air Portugal

- Thai

- Turkish Airlines

The other global airline alliance partners include:

- Aer Lingus

- Aeromar

- Air Dolomiti

- Airlink

- Azul

- Boutique Air

- Cape Air

- Edelweiss

- Eurowings

- Eurowings Discover

- Hawaiian Airlines

- JSX

- Juneyao Air

- Olympic Air

- Silver Airways

- Virgin Australia

- Vistara

Book Hotel Rooms

You can book a hotel through a hotel booking site or a hotel loyalty program.

The partner hotel booking websites and earning potential are:

- United Hotels: 2x

- Villas of Distinction: 3x

- Vrbo: 3x

- RocketMiles: 1,000 to 10,000 miles per night

- PointsHound: Up to 10,000 miles per night

The United Hotels booking site is powered by Hotels.com and lets you earn rewards from brands without direct partnerships with the airline.

If you prefer to book directly through the hotel, the partners include:

- ALL — Accor Live Limitless (Point conversions only)

- Choice Privileges

- Hilton Honors (Point conversions only)

- IHG One Rewards

- Radisson Rewards Americas

- Shangri-La Circle

- World of Hyatt

- Wyndham Rewards

Related: Best Hotel Credit Cards

Rental Cars

Booking an Avis or Budget car rental through United.com lets you earn up to 1,250 award miles. How much you earn depends on your MileagePlus status tier and if you have a co-brand United Airlines credit card:

- General MileagePlus Member: 500 miles

- MileagePlus Chase cardmembers: 750 miles

- Premier Silver and Gold members: 1,000 miles

- Premier Platinum and Premier 1K: 1,250 miles

You can also save up to 35% on time and mileage charges with the United Airlines rental car discount.

United also provides award miles through:

- Sixt: 3x miles

- Carmel: 50 miles (within New York) or 100 miles (outside New York) plus up to 2x miles on completed online bookings.

Related: Best Credit Cards for Rental Cars

Take a Cruise

You can book a cruise from over 25 providers through United Cruises.

Brand loyalty has its benefits and United MileagePlus cardholders can earn up to 45,000 miles per booking. You can earn up to 25,000 miles when booking with another travel rewards credit card.

Premier members can enjoy special onboard extras on select cruises. Several possibilities include spa treatments, complimentary wine, and onboard spending credit.

MileagePlus X

The MileagePlus X mobile app can make finding ways to earn United miles as you shop and dine easier. This app is available from Google Play and the Apple App Store.

You will see the latest limited-time offers and ongoing earning promotions without visiting the United website.

There are exclusive app-only offers as well. One example is earning up to 5x bonus miles when dining or shopping online and in person. In addition, United cardholders can also receive a 25% primary cardmember bonus.

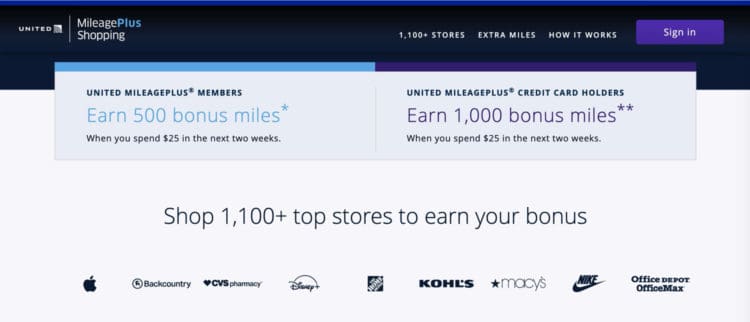

United MileagePlus Shopping

Shopping online through the United MileagePlus Shopping portal lets you earn miles from over 1,100 online stores.

Most online merchants offer up to 6 miles per $1. Unique services such as flower delivery and wine subscriptions tend to have higher earning rates of at least 15 miles per $1.

An optional browser extension lets you activate shopping sessions directly from the merchant’s website. You can access these offers through the MileagePlus X app as well.

Several brands also offer in-store cash back when you link a payment card.

This shopping rewards gateway awards up to 1,000 bonus miles when spending at least $25 within the first 14 days:

- 1,000 bonus miles for United MileagePlus credit card holders

- 500 bonus miles for United MileagePlus members

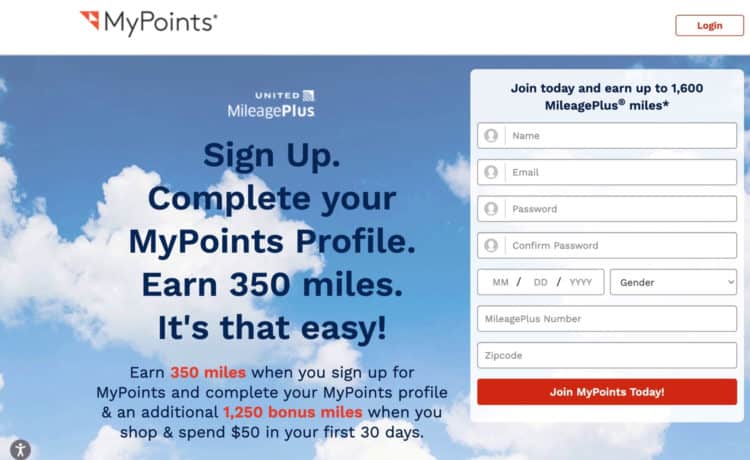

Shop Through MyPoints

MyPoints is a micro-task website that awards points for completing various activities, including:

- Online surveys

- Playing games

- Testing apps

- Signing up for product offers

- Shopping online

- Redeeming in-store grocery offers

Consider this offer if you want to earn bonus points through their online shopping portal. New MyPoints members receive 350 United Miles. Next, you can earn 1,250 miles by spending at least $50 within the first 30 days.

In addition to the one-time bonus miles signup bonus, you will receive bonus points that you can redeem for United MileagePlus miles or gift cards to your favorite stores and restaurants.

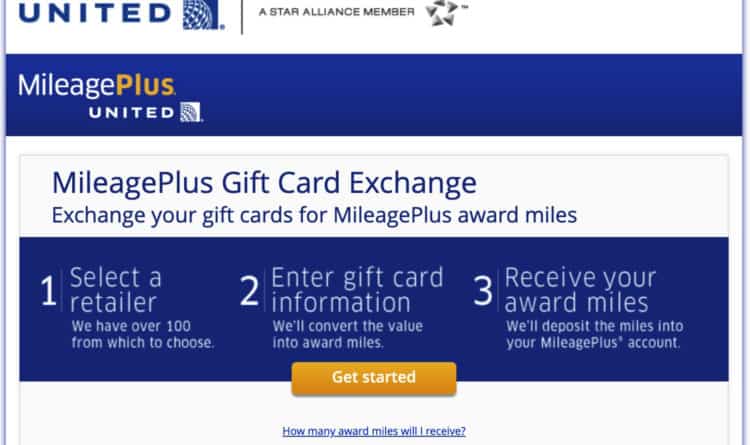

Exchange Unwanted Gift Cards

Instead of letting an unwanted gift card collect dust in a desk drawer, you may be able to exchange it for United miles. The MileagePlus Gift Card Exchange accepts gift cards from over 100 brands.

The minimum gift card value is $15 but there isn’t necessarily a redemption maximum.

The exchange rates can differ by brand but here’s a general estimate:

- $25 card balance: 670 miles

- $50 balance: 1,330 miles

- $100 balance: 2,660 miles

This feature is available to United MileagePlus loyalty accounts open for at least 90 days and with a positive points balance.

United MileagePlus Dining

Participating restaurants, bars, and cafes offer award miles through United MileagePlus Dining. Dining-in, delivery, and takeout orders are all eligible for dining rewards.

New members can receive 1,500 bonus miles by spending at least $25, paying with a linked payment card, and leaving a restaurant review within the first 30 days.

HomeChef Delivery Kits

New HomeChef members receive 1,000 miles on each of the first five boxes for 5,000 miles total. There are no additional rewards after this signup promotion but it can be an inviting way to try this food delivery kit.

Broadway Tickets

If you love Broadway performances, you can earn up to 2,000 bonus miles by purchasing show tickets through Audience Rewards. This platform is the “official rewards program of Broadway and the arts.”

You will earn at least 100 miles per ticket for various performances in New York.

Pay Rent

By paying rent through Bilt Rewards, you can earn 1 Bilt Point per $1 on the first $50,000 in annual rent payments. Over two million homes are part of the Bilt Rewards Alliance and allow you to pay from a linked banking account.

It’s also possible to earn rewards if you don’t live in a Bilt Property after applying for the Bilt Mastercard® with no annual fee. You will earn 1x points on the first $50,000 in annual rent payments and won’t pay credit card processing fees.

If your landlord doesn’t accept credit cards, the rent payment app will send an ACH transfer or a paper check on rent day. This card also earns 3x points on dining, 2x on travel, and 1x on everything else but you must make at least 5 card purchases per month to earn rewards.

After accumulating points, you can transfer Bilt Points to United Airlines at a 1:1 ratio. The transfer minimum is 2,000 points.

You can also redeem your points for award travel at 1.25 cents each through the Bilt Rewards travel portal which may be a more valuable option at times.

Pay Utility Bills

If NRG or Reliant is your home utility provider, you can earn United miles when paying your utility bill. The earning potential is a little different with each provider.

NRG

You can earn 2 miles per $1 on the supply portion of your NRG electric and natural gas bills.

When switching to NRG for electricity, you can receive 20,000 bonus miles plus three months of introductory pricing lower than the competitor’s rate.

You will earn 2,500 bonus miles when switching to a NRG natural gas account plus 2 miles per $1 on the supply portion of your monthly bill.

This promotion is available in:

- Illinois

- Massachusetts

- New Jersey

- Ohio (electric only)

- Pennsylvania

Reliant

Texas households living within the Reliant service area can enroll in the Reliant Secure® 24 plan and earn up to 27,000 miles. You will receive 15,000 miles when signing up and then 500 miles per month during the 24-month plan period.

Purchase a Home Security System

You can receive 7,000 bonus miles when purchasing a SimpliSafe home security system. This offer requires purchasing at least one base station, one keypad, and three additional sensors.

Get a Mortgage

Receive 25,000 bonus United Miles after closing or refinancing a home loan through Rocket Mortgage.

Comparing rates from multiple lenders is still advised to have the lowest lifetime loan costs. Your comparison process can also include Guaranteed Rate to earn 50,000 miles on a home purchase loan or mortgage refinance.

Switch Auto Insurance Companies

It’s a good idea to periodically check your car insurance rates to verify you’re paying the lowest premium possible for your desired coverage. If California Casualty (CalCas) meets your needs, you can earn up to 20,000 bonus miles by swapping insurers:

- 7,500 miles after four continuous months of coverage

- 5,000 miles after your first and second policy renewals

- 2,500 miles after the third policy renewal

You can also enjoy free ID theft protection and pet protection is available too.

Unfortunately, residents in these states cannot participate:

- Alaska

- Hawaii

- Maryland

- Massachusetts

- Michigan

- New York

- North Carolina

- Wisconsin

Norton Identity Theft Protection

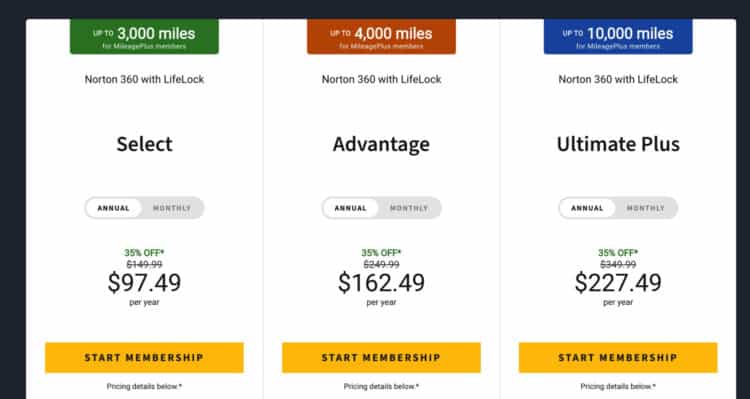

If you’re considering signing up for an identity theft protection service, you may join Norton 360 with Lifelock.

United customers can earn up to 10,000 bonus miles depending on the package.

Timeshifter Jet Lag App

Another way to earn United miles while traveling is through the Timeshifter app which helps fight jet lag. A one-year subscription ($24.99) yields 500 miles and a single round-trip plan ($9.99) awards 200 miles.

VisaCentral Travel Documents

United customers receive discounted rates and up to 1,000 miles on VisaCentral services:

- 1,000 miles on visa and passport services

- 500 miles on Australian ETA and US ETA services

These services are available within these countries:

- Australia

- Canada

- United Kingdom

- United States

Take Online Surveys

You can earn at least 300 miles by completing your first survey through Opinion Miles Club.

For transparency, future surveys will most likely earn 100 miles or less but this is one of the few ways to earn United Miles without a purchase. However, you can qualify for higher-paying surveys if you’re a frequent shopper and like sharing your buying habits.

Charity Donations

United Airlines has an ongoing partnership with the National Foundation for Cancer Research (NFCR) to award miles for charity donations. Tax-deductible contributions exceeding $25 earn 10 miles per $1.

The airline also offers limited-time promotions to MileagePlus loyalty program members and co-brand cardholders to earn miles while supporting causes.

Transfer United Miles to Another Person

Now that United miles no longer expire, there isn’t the pressure to use them or lose them. However, an inactive travel account may still wish to transfer their miles to you and put them to good use.

Mileage transfers incur a flat one-time $30 processing fee plus $7.50 per 500 miles. The transfer limit is 100,000 miles.

Buy or Gift Miles

The MileagePlus loyalty program also lets you buy or gift miles on demand. This option can be expensive as the everyday price is $35 per 1,000 miles and the purchase minimum is 2,000 miles ($70).

Waiting for seasonal sales can make the purchase price more affordable with discounts up to 40%.

Another option to buy discounted miles and PQP when you book a flight:

- Award Accelerator: Buy award miles at a discount when buying a United flight.

- Premier Accelerator: Purchase bonus PQP in combination with award miles.

The Vacationer’s Final Thoughts

United Airlines provides more ways to earn airline miles than most frequent flyer programs. In addition, there are many airline alliance partners and credit card reward opportunities to earn miles while traveling and on daily purchases.

Along with being easy to earn United miles, you can also quickly redeem your miles for award flights for domestic and overseas trips. The Saver Award fares are also worth exploring so you don’t have to work as hard to earn the miles you need for your next award trip on United or a Star Alliance partner.

Further Reading: Best Ways to Earn Delta SkyMiles

Editorial Disclosure: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Get The Vacationer Newsletter

Get highlights of the most important news delivered to your email inbox