Credit Card Travel Survey 2022 – 83% Will Pay for Next Vacation With a Credit Card But Only 35% Have a Travel-Focused Card

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Our Summer Travel Survey for 2022 revealed that 81% of people will vacation this summer. That is up from last year’s summer travel survey where 68% said they would vacation. Travel is certainly coming back as virus cases decrease and the US continues to combat the COVID-19 pandemic. According to our Sustainable Travel Survey, 62% of people consider cost the most important factor when booking travel. One of the best ways to decrease cost and increase amenities for travel is via credit card usage.

We created this Credit Card Travel Survey to measure public knowledge and understanding of travel-rewards focused credit cards. Do people currently have travel-rewards focused credit cards? How do consumers prefer to redeem their points or cash back? Do vacationers think about credit card bills while on the actual vacation? Below you can find the answers to these questions and more.

Table of Contents

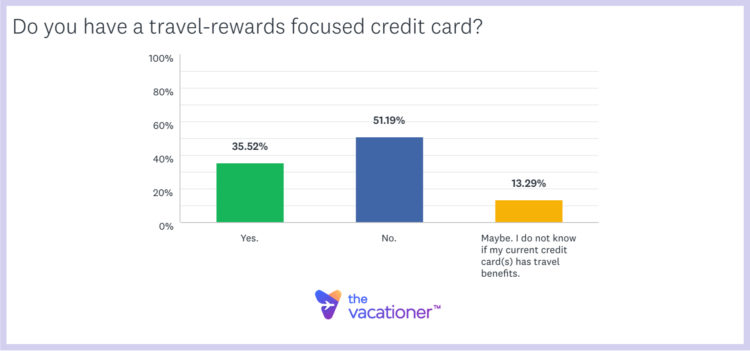

Do you have a travel-rewards focused credit card?

Let’s take a look at the survey results:

- Yes. — 35.52%

- No. — 51.19%

- Maybe. I do not know if my current credit card(s) has travel benefits. — 13.29%

Interesting Demographic Comparison — A much larger percentage of men than women have a travel-rewards focused credit card. Our survey revealed 42.26% of men said they had one while only 29.43% of women said they did. Additionally, we should note that 15.85% of women were unsure whether their credit card offered travel benefits. Only 10.46% of men said they were unsure. Therefore, it’s probable that the gap between men and women having travel credit cards is even bigger.

Key Takeaway — Nearly 65% of adult Americans do not have or are unsure if they have a travel-rewards focused credit card. The percentage represents over 164 million Americans according to census.gov. This is a substantial number of people potentially not receiving travel benefits on their purchases. Some of these travel-rewards credit cards like the Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, Capital One Venture X Rewards Credit Card, and The Platinum Card® from American Express ($695 Annual Fee – See Rates & Fees) do have annual fees. However, others such as the Chase Freedom Flex℠ do not. There is a travel credit card for everyone’s personal finances.

The Vacationer Tip

If you do not have a travel-rewards credit card, our highest recommendations are the Chase Sapphire Preferred® Card, the Capital One Venture X Rewards Credit Card, and the Citi Premier® Card. If you would like to see other offers, Click to See All of Our Recommended Travel Credit Cards.

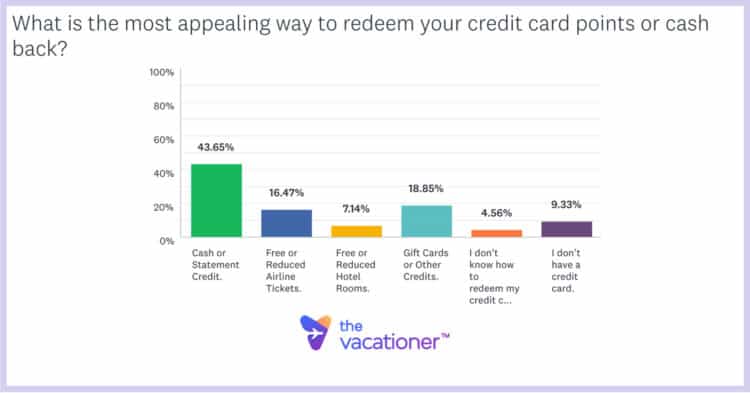

Let’s take a look at the survey results:

- Cash or Statement Credit. — 43.65%

- Free or Reduced Airline Tickets. — 16.47%

- Free or Reduced Hotel Rooms. — 7.14%

- Gift Cards or Other Credits. — 18.85%

- I don’t know how to redeem my credit card points. — 4.56%

- I don’t have a credit card. — 9.33%

Interesting Demographic Comparison — Those surveyed over 60 were most likely to want to redeem credit card points with cash or statement credit. 51.65% of American adults over 60 years old said cash or statement credit was the most appealing. But, only 9.89% of these people said free or reduced airline tickets were the best. An even lesser 2.20% said free or reduced hotel rooms was most appealing. The airline and hotel credits were substantially lower than all of the other age brackets. For example, the 30-44 age bracket had 21.21% of people thinking free or reduced airline tickets were best. And, the 45-60 age bracket had 8.99% think free or reduced hotel rooms was most appealing.

Key Takeaway — Over 43% of adult Americans feel the most appealing way to redeem points is with cash or statement credit. While being convenient, this is typically the worst way to get maximum value for credit card points. Many cards will offer more valuable methods for redemption. Redeeming for travel or transferring the points to an airline or hotel can make the points worth much more.

If you pay for your next vacation with a credit card, how much will you put on it?

- $500 or Less. — 11.31%

- $501 to $1,000. — 24.80%

- $1,001 to $1,500. — 20.04%

- $1,501 to $2,000. — 9.33%

- $2,000 or More. — 17.46%

- I will not put my next vacation on a credit card. — 17.06%

Interesting Demographic Comparison — People residing in the East South Central region are the least likely to put their next vacation on a credit card. This region encompasses the states of Kentucky, Tennessee, Alabama and Mississippi. 34.48% of people in that region said they will not put their next vacation on a credit card. Conversely, the East North Central region is most likely to use a credit card for their next vacation. This region encompasses the states of Ohio, Indiana, Illinois, Michigan and Wisconsin. Only 8.00% of people in this region won’t use a credit card.

Key Takeaway — Nearly 83% of American adults will put their next vacation on a credit card. Almost 27% of all American adults will put over $1,500 on their credit card for their next trip. The 83% represents over 211 million people and the 27% represents over 68 million people. These are substantial figures. The remaining 17.06% not using a credit card are potentially missing out on valuable cash back and other rewards. Cash back and rewards are generally free incentives that every person should use to their advantage.

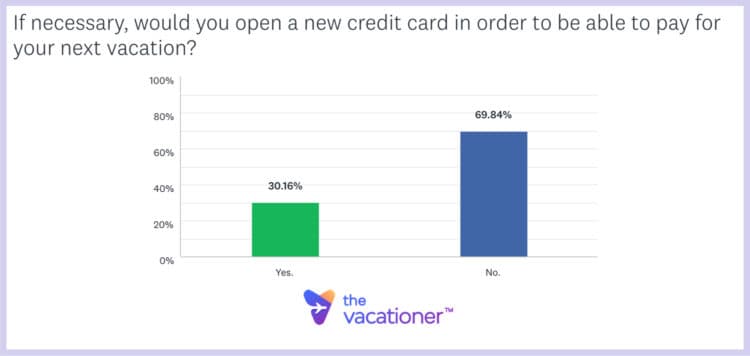

Let’s take a look at the survey results:

- Yes. — 30.16%

- No. — 69.84%

Interesting Demographic Comparison — American adults over 60 are the least likely to open a new credit card to pay for their next vacation. And, those surveyed proved this by a significantly wide margin too. Only 8.79% of people over 60 said they’d be willing to open a new credit card to pay for their trip. However, 36.03% in the 18-29 age bracket said they would. Next, 31.31% aged 31-44 would. And, 35.96% in the 45-60 age bracket indicated they would. The over 60 American adults seem a lot more cautious than their younger peers.

Key Takeaway — Nearly 1 in 3 American adults would open a new credit card specifically to pay for their next vacation. This figure represents almost 77 million people. Over 30% of people being willing to open a new credit just to pay for a vacation seems like a high number. It makes sense as to why credit card companies put so many resources into marketing new cards targeting people!

Do you think that travel is a worthy reason to go into debt?

Let’s take a look at the survey results:

- Yes. — 25.79%

- No. — 74.21%

Interesting Demographic Comparison — Men are more likely than women to think that travel is a worthy reason to go into debt. 29.29% of American adult men stated that they think travel is a worthy reason to go into debt. However, only 22.64% of American adult women think travel is a worthy reason to go into debt.

Key Takeaway — More than one in four American adults think travel is a worthy reason to go into debt. The 25.79% that think this represent over 65 million people in the United States. This is another very surprising stat and definitely shows some people are willing to travel at any cost, literally.

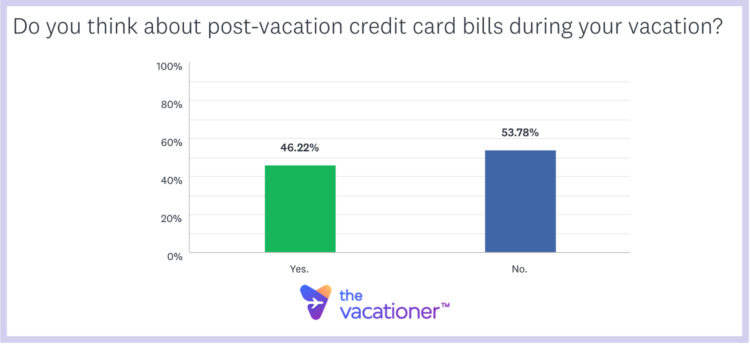

Let’s take a look at the survey results:

- Yes. — 46.22%

- No. — 53.78%

Interesting Demographic Comparison — The youngest generation aged 18-29 think about post-vacation credit card bills most while on the actual vacation. 54.48% of these Americans said they consciously thought about their credit card bill while on vacation. This is higher than the 47.47% of Americans aged 30-44 who worried about it. Additionally, it is also higher than the 45.51% aged 45-60 who did. Lastly, it’s higher than the 34.07% of American adults over 60 who think about their bill on vacation.

Key Takeaway — Over 46% of American adults or nearly half of people think about post-vacation credit card bills during their vacation. This equates to about 118 million people. That means 118 million people are worrying about their post-vacation credit card bills instead of enjoying their vacation. Many Americans only get to vacation once per year and should be able to focus on their relaxation.

Let’s take a look at the survey results:

- More Likely. — 14.51%

- Less Likely. — 29.22%

- About the Same. — 56.26%

Interesting Demographic Comparison — Our survey revealed men are slightly more likely than women to sign up for a travel credit card post-COVID. 16.74% of males said they were more likely while only 12.50% of females said they were. Additionally, the 18-29 age bracket had the most people saying they were more likely. Conversely, the over 60 Americans adults had the most people say they were less likely.

Key Takeaway — Overall American adults are less likely to sign up for a travel credit card post-COVID than they were pre-COVID. This is true for every age group which is astounding given the many benefits and rewards of such a credit card. Perhaps some Americans are still weary of travel given the pandemic is still ongoing. However, once life returns to normal we urge travelers to consider the many free rewards possible from a travel credit card.

Survey Methodology

This Credit Card Travel Survey was conducted by SurveyMonkey on behalf of The Vacationer. In total, 504 Americans over the age of 18 were polled between April 21 and April 22. Of those surveyed, 47.42% were male and 52.58% were female. The age breakdown of participants included in this survey was 26.98% in the range 18-29, 19.64% in the range 30-44, 35.32% in the range 45-60, and 18.06% over 60. This survey has a confidence level of 95% and a margin of error of ±4.454%. You can learn more about SurveyMonkey’s sampling method by clicking here.

The questions were chosen and the results were analyzed by the post author, Eric Jones, who is a Mathematics and Statistics Professor at Rowan College South Jersey.

Editorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

Get The Vacationer Newsletter

Get highlights of the most important news delivered to your email inbox

See also

Summer Travel Survey 2022 — Nearly 81% to Travel, 42% to Travel More than Last Summer, Nearly 51% to Fly on a Plane, 80% to Road Trip

Sustainable Travel Survey 2022 — 87% Say It’s Important, 82% to Make More Eco-Friendly Travel Decisions, 78% Pay More to Lower Carbon Footprint